Reverse mortgages are going to become more popular in Canada. As more of the population ages into retirement there is going to be an increasing demand for retirees to access the equity value in their homes.

Some other good resources on reverse mortgages are:

CHIP and Equitable offer these products, so they will outline them in a better light. CRA’s article is good and outlines all the factors with less bias.

What is a reverse mortgage?

A reverse mortgage, as its name implies is a mortgage, but the money flows opposite compared to a traditional mortgage.

Traditional Mortgages

- You don’t have enough money to buy a house, but you do have a good income

- The bank determines your income can service the monthly payments and gives you the money to buy a house

- Over time you pay down the mortgage. Each month you increase your equity in the home until the mortgage is paid off.

Reverse Mortgages

- You own your house with no mortgage, but you don’t have an income

- The bank determines the value of your home is enough to cover their loan, and they deposit funds into your bank account each month to provide “income”. Each month your “income” results in an increased mortgage balance

- Over time the value of your mortgage increases. When you sell your home, die or default the mortgage is paid back and you’re left with the excess equity value.

Put more simply…

Why would I take out a reverse mortgage

The reason that reverse mortgages are attractive to retirees is because they are underwritten based on asset value, the value of your home. Not your income, which traditional mortgages use for underwriting.

An older retired person usually has a low income, but they have a lot of equity in their home. To access this equity they would have to

- Sell their home

- Which they may not want to do

- Take out a mortgage or HELOC

- Which they won’t qualify for

Reverse mortgages originated to solve this problem. Homes in Canada are stable assets, and conservatively lending against them is profitable for the lender and frankly a no brainer.

Who provides reverse mortgages in Canada?

Reverse mortgages are provided by

- Equitable Bank

- Home Equity Bank under their “CHIP” program (Canadian Home Income Plan)

Is it true that I never have to pay back my loan?

It’s true that you don’t have to make “payments” back on your loan while your alive. But banks aren’t in the business of lending money for fun. The repayment of the loan happens when

- The home is sold

- You die

The value of the loan accrues each month based on the interest rate of the loan. So while you don’t have to make monthly payments, the value of your loan increases every month if you do not make a payment to offset this growth.

Are reverse mortgages a good solution for retirement?

They can be a good solution to supplement retirement income. The key word is “supplement”, depending entirely on a reverse mortgage is not an ideal solution.

This is because the interest rates on these loans are typically quite high, and they compound. Compared to a traditional mortgages with lower rates, but more importantly the value of your mortgage does not compound because you’re actively paying it down.

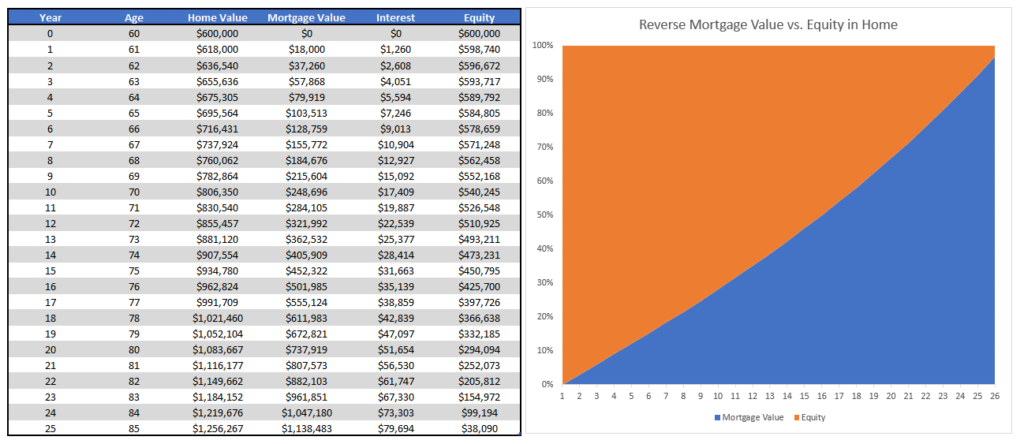

If you take a reverse mortgage out in your 60’s to supplement your income, the size of the loan in 20 years will be quite large and the majority of your property value will be attributable to the lender.

How much will the bank lend me?

In a lumpsum, typically up to 55% of the equity value in your home. But over time the value of the loan can increase beyond this as interest accrues.

Some lenders have a “99% guarantee” which means their loan will never exceed 99% of the value of your property assuming you continue to live in and maintain the property.

Are there different types of reverse mortgages?

Yes there are. They all follow the same flow of funds as outlined above, but you can either

- Receive a large lumpsum of money upfront

- Receive a small amount of money each month

Unless there’s a specific reason to receive a large lumpsum, the second option is usually better because the interest accrues only on that small portion. Whereas when you take the lumpsum value interest is accruing on the entire amount whether you’re using it or not.

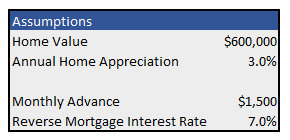

Reverse Mortgage Example

By the end of the simulation the bank owns most the equity in the property, and the value of their loan and is increasing by ~ $80,000 annually.

So should I take out a reverse mortgage?

I’m not saying reverse mortgages are bad. They are a solution for low income retirees to access the equity value in their home.

I am saying that before you utilize a reverse mortgage you should understand

- All the other forms of retirement income you can receive

- How much you’re going to end up owing in 5, 10, 15 years if you do use a reverse mortgage.

- These products work better over short periods of time as the interest on the loan has less time to compound

If you can get away with making small monthly withdrawals for 5 or 10 years, then I think reverse mortgages do a fantastic job. The risk is if you plan on this product for the majority of your retirement income.

Everyone’s retirement and financial goals are different. Sit down and understand what would need to happen to achieve your financial goals. Then you can evaluate the products out there, and whether a reverse mortgage will help you hit those goals.