Whether you think about your home as a retirement asset depends on whether you can retire without using it as one. Simple as that.

I understand why people don’t like to view their home as an asset. They have memories in the home, it’s where they raised a family. Maybe it was even your parents home that you inherited.

But when push comes to shove if you had the choice of being homeless or selling the house, you’d sell it.

So, what are some options if you don’t want to sell your home?

Rent out your basement

If you can drive an extra $1,000 – $2,000/month of income from renting a property that would help.

Whether you go this route depends on your comfort level. We’ve discussed this with clients, and sometimes they are just not comfortable having someone else in the house.

The viability of this option also depends on the layout of your house. Unless you already have a separate entrance you’ll have to get a contractor to do this for you. And the cost to do this will determine if this is an attractive option

- If it costs $25k to add a side entrance and you can rent your basement for $1,500/month. It will pay for itself in 1.5 years – the money after that time will accumulate to you.

Get a reverse mortgage

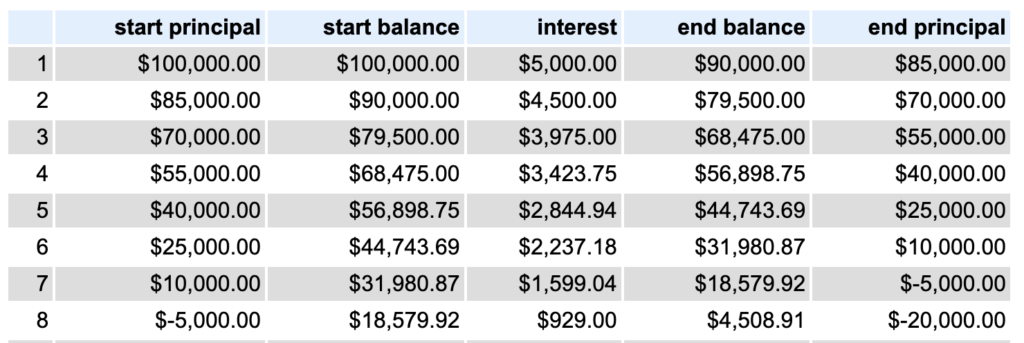

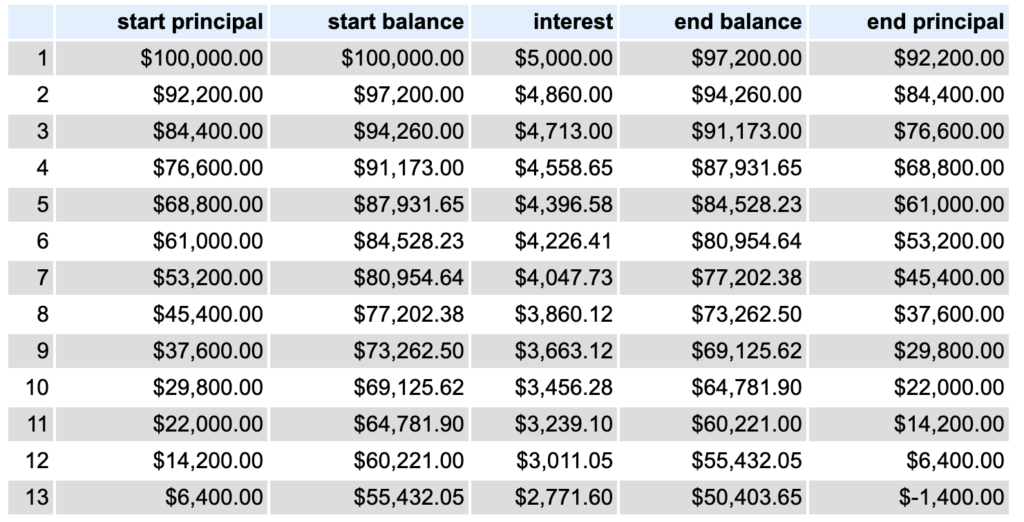

A reverse mortgage allows you to access the equity in your home without selling it. Before you go down this path you should consider the long term effects of using a reverse mortgage. The interest can get very expensive if they are used as a primary income source for 20+ years.

As the name suggests a reverse mortgage is the reverse of a regular mortgage.

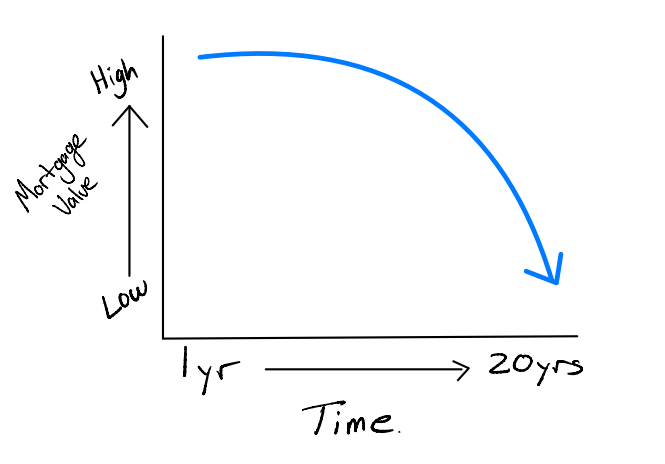

With a regular mortgage the balance decreases over time as you pay it down.

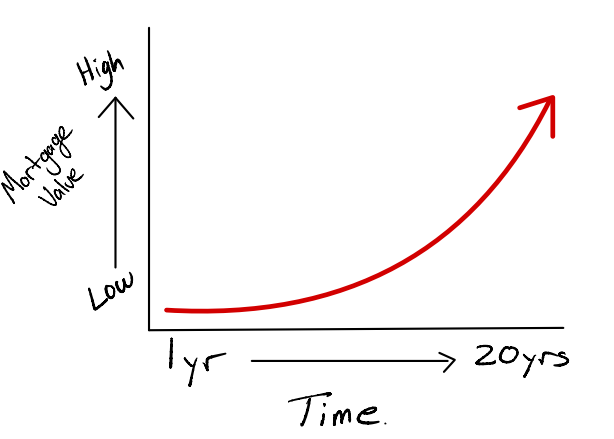

With a reverse mortgage the balance increases over time as you withdraw the equity in your home as income. The size of the mortgage increases in direct proportion to how much income you withdraw plus interest.

Reverse mortgages are a good thing, and they can be very helpful to supplement your income in retirement. You just don’t want to rely entirely on them if you can avoid it.

Have your adult kids move in with you.

Or if they are already living with you, have them pay rent.

Splitting costs across multiple people lessons the financial burden on each person involved. If your son earns $70,000 each year and is renting an apartment for $2,000/month, but can move in with you and pay $1,000/month it’s a win-win.

His living expenses decreases by half, and you’ve got an extra $12,000 of annual income.

Obviously there’s more to this than just money – but it’s a sacrifice you may have to make if you don’t want to sell your home.

Delaying Retirement

Before you retire it’s a good idea to sit down and look at your overall financial picture. If you’re working with a financial planner they should be able to model your retirement and know (approximately) how long your money will last.

With that information you can determine whether it makes sense to retire or to continue working for a few more years.

Retirement planning is not a plan you can “set it and forget it”. Projections should be revisited and updated on an annual basis (at a minimum)

Some Combination of the Above

You don’t have to pick just one strategy. You could

- Delay retirement by 2 years

- Plan to withdraw $500/month from your home’s equity starting in 10 years

- Have your adult child move in and pay you $1,000/month

Or maybe you…

- Decide to switch from full time to part time. But do this for 6 more years

- Add a separate entrance to your home and rent it out for $1,700/month

Any combination of these strategies are fine. They are not all or nothing decisions.

Closing Thoughts

I think it’s under appreciated how small changes can have outsized impacts for retirement.

A 65 year old client with:

- $20,000 of pension income

- $35,000 in expenses

- $100,000 in investments

Is expected to run out of investment assets in 6-7 years.

Minimum wage in Canada is ~ $15/hr. $30,000 annually for full time work.

If you decided to work somewhere for 10 hours/week you’d pocket an extra $7,200.

Look at how big a difference this makes.

You don’t have to work, you could rent your house, have family move in with you, take a reverse mortgage.

You will have to make some sacrifice if selling your home is not an option. The sacrifices don’t have to be huge but you’re going to have to make them.