Safe Investments Can Be Dangerous

What do we mean when we refer to an investment being “safe”?

The most common interpretation is that the value of the investment doesn’t change much on a day to day basis.

Makes sense.

You can put your money into a 6 month GIC (Guaranteed Investment Certificate) and expect that in 6 months you will receive your money back plus some interest.

You can’t have the same expectation with the stock market.

In 6 months, you may actually have less money than you originally invested.

Not losing money is a good proxy for safety over short periods of time. But, it is not an appropriate measure of safety over long periods of time.

In fact, this “safety” actually turns out to be quite dangerous over long periods of time.

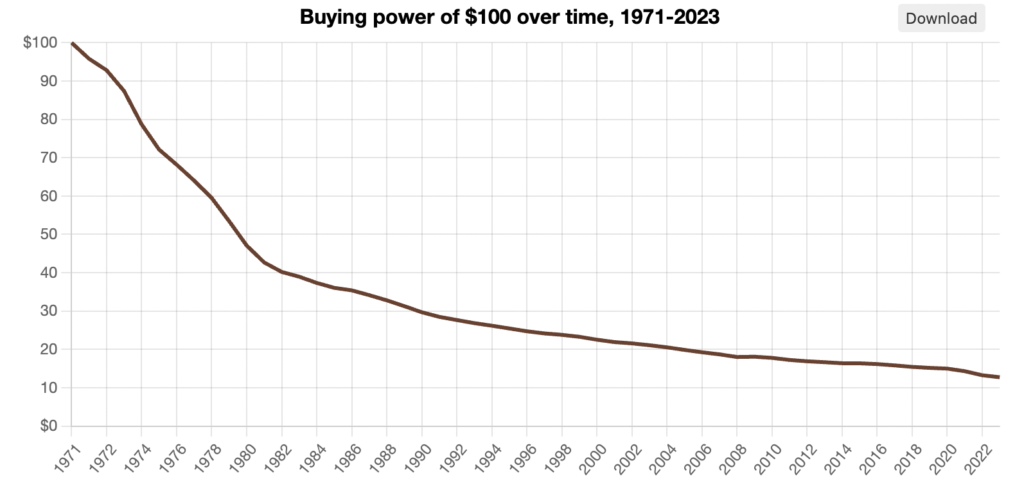

Look at how the value of cash has decreased over the last 50 years.

By holding a supposedly “safe” investment, you lost 87% of your money. Or, more specifically, you lost 87% of your purchasing power.

While your bank balance would still say $100, most people understand that $100 “back in the day” does not buy as much stuff as it used to.

This is why holding cash is risky over long periods of time.

If cash is bad in the long term, what should I do with my money?

For long term savings, the primary goal should be, at a minimum, to preserve the purchasing power of your savings.

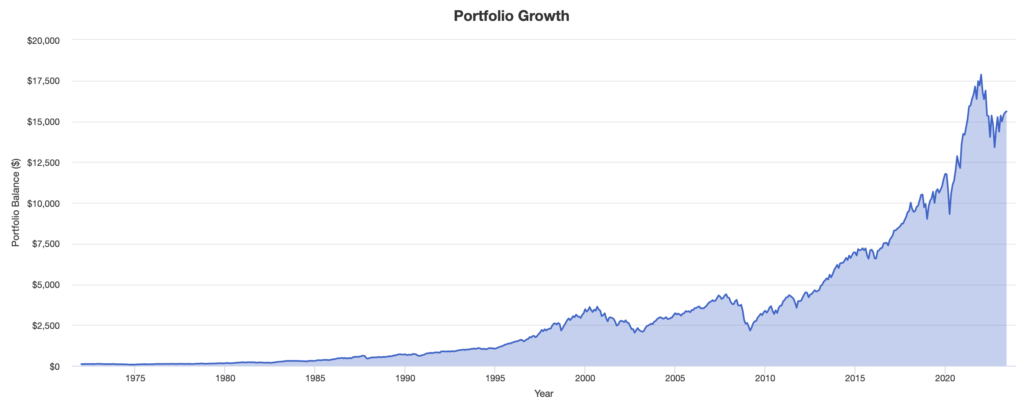

Historically the best vehicle to do that with has been the stock market.

The risk profile of the stock market is the opposite of holding cash.

Over short periods of time, the value of your stock portfolio can decrease, quite substantially I may add.

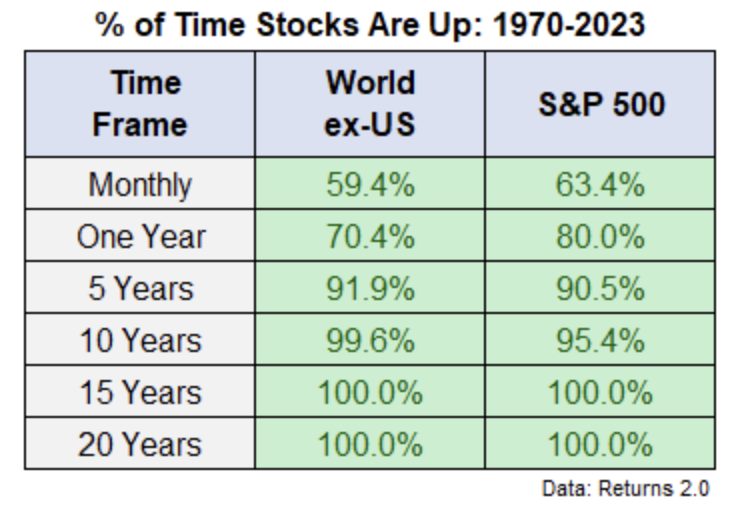

But, as time goes on, the value of your stocks usually increases. And the longer you are able to keep that money invested, the more likely that will be the case.

By keeping your money in cash, or “safe” investments, you’re exposing yourself to an even bigger risk. The risk that your savings are worth less in the future.

So, cash is risky and stocks scare me. What should I do?

Just because cash is a poor investment over the long term does not mean that it should not be a part of your portfolio. Especially if you are expecting to make a significant purchase in the near term.

If you are planning to buy a house within the next few years you can set aside cash for that purpose.

That’s okay.

Ignore the advice that you should always maintain a large portion of your investments in stocks. It’s totally irrelevant to your individual financial goals.

For example, a 28 year old with $150k has the following goals:

- Use $75k for a home downpayment (short term)

- Keep $15k in their bank account (short term)

- Leaving $60k for retirement savings (long term)

This person could have a portfolio of the following investments:

- $75k in a 6 month GIC

- $15k in a Savings Account

- $60k in North American Stocks

Nobody would recommend the average 28 year old keep over 1/2 of their investments in stocks. But that’s a rule of thumb – it doesn’t apply to this specific situation.

Having your investments match the timeframe for each of your goals is what matters.

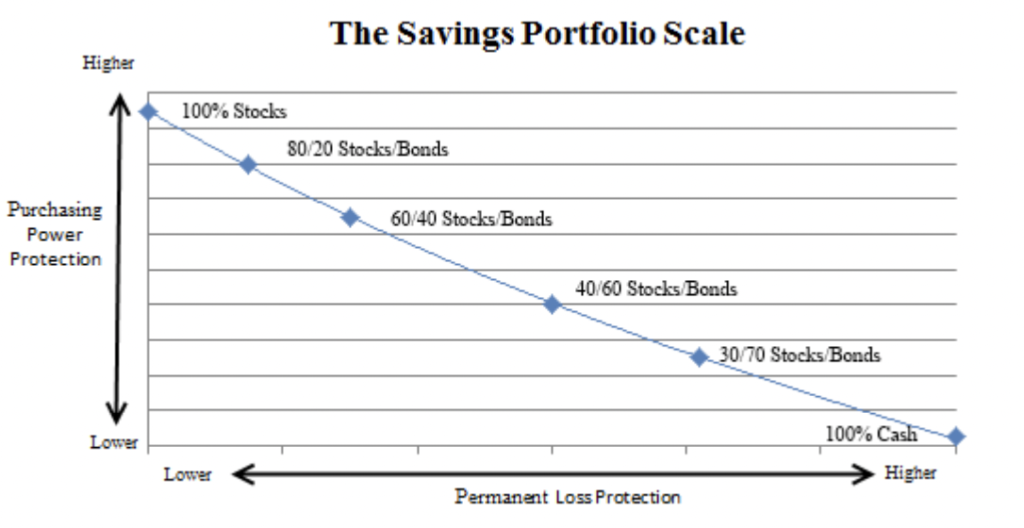

Stocks are for maintaining your purchasing power over time. They are for long term goals, like retirement or your kid’s education.

Cash, Bonds, GICs are for making sure the value of your money doesn’t change much on a day-to-day basis. Protecting from “permanent loss” in the chart above. This makes them good for funding short term goals, like buying a house.

Why do we invest our money at all?

Maybe some would say it’s to get rich. Though there are better ways to use your money if that’s your goal.

The goal for most people allocating their savings is to fund their future goals.

Whether those goals are short term or long term will determine the appropriate investment decisions to make.