People have mixed feelings on whether a home is an investment. Some believe that you should rent and use the excess savings to invest in the stock market. Others believe getting into a home as quickly as possible is the foundation of setting yourself up financially.

How well has Canadian Real Estate done?

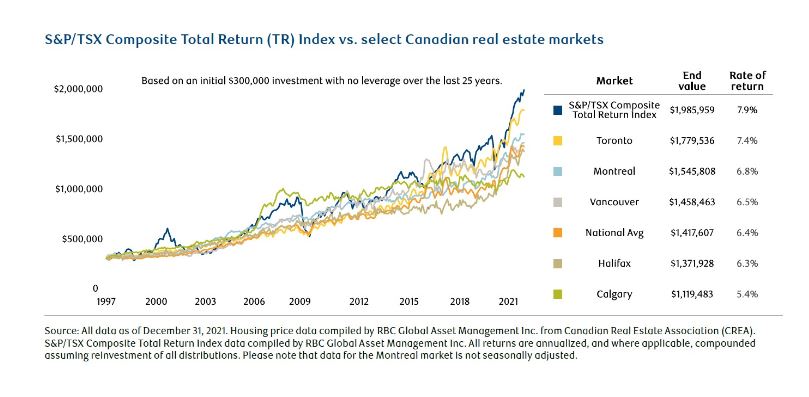

RBC highlights the performance of real estate in major metros compared to Canadian equities

Overall real estate has underperformed equities. But this chart views things in a simple manner, with many assumptions that don’t apply to most homeowners. Specifically….

- Real estate purchases are typically highly mortgaged (or leveraged), which can magnify gains. In Canada, it’s not uncommon to see loan-to-value ratios of 80% or more. By contrast, equity market investments are typically not purchased with borrowed funds.

Costs such as real estate commissions, taxes, maintenance and repairs are not included in the data. Neither is potential rental income. These would all impact investment returns in real estate. - One cannot invest directly in an index. Transaction costs, investment management fees and taxes are not reflected, which would negatively impact returns for equity investments. Past performance is not a guarantee of future results.

All of the ifs, ands or buts, make it difficult to evaluate. These are real things to consider, and brushing them off in asterisks takes away the entire discussion. Let’s break down some of the assumptions:

- Transaction Costs

- Today, homes have higher transaction costs compared to stocks. Stocks also used to have high transaction costs 20 years ago, but that’s no longer the case.

- Tax

- On the sale of a principal residence you pay no tax, a big leg up compared to stocks.

- Carrying Costs

- The carrying costs for a home, property tax, insurance, utilities, general maintenance are much higher than stocks, which you don’t have to put any extra money into if you don’t want. And if you have a mortgage on your property the interest expense will be your biggest carrying cost.

- Leverage (Mortgage)

- Leverage (debt) amplifies good results into great results, and bad results into horrible ones. But, leveraging your home has historically been a good strategy. More importantly it allows people to get into the asset building “game” by borrowing funds to purchase an asset they otherwise would not be able to buy.

Building a model that takes everything into account

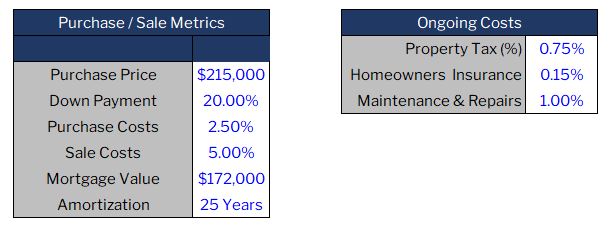

To get a more accurate view of the investment returns of home ownership I’ve used the following assumptions.

- Costs to Purchase

- 2.5% of Purchase Price

- Costs to Sell

- 5% of Sale Price

- Property Tax

- 0.75% of home value, annually

- This varies depending on where you live

- Insurance,

- 0.15% of home value, annually

- Repairs & Maintenance

- 1% of home value, annually

- Mortgage Rates

- I’ve assumed that the property was “refinanced” at no cost each year at the current mortgage rate. This improves the returns from home ownership as it provides the benefit of decreasing mortgage rates. Even though homes are typically refinanced every 5 years

- I’ve also assumed a 25 year amortization, the model does not re-amortize the mortgage each year when re-financed, it only adjusts the interest rate

- Home Values

- I’ve used aggregate Canadian property values across the provinces. This will vary depending on your specific location. Different locations within provinces can have large discrepancies in growth.

- Down Payment

- I’ve assumed a 20% down payment

Summarized, in the following tables

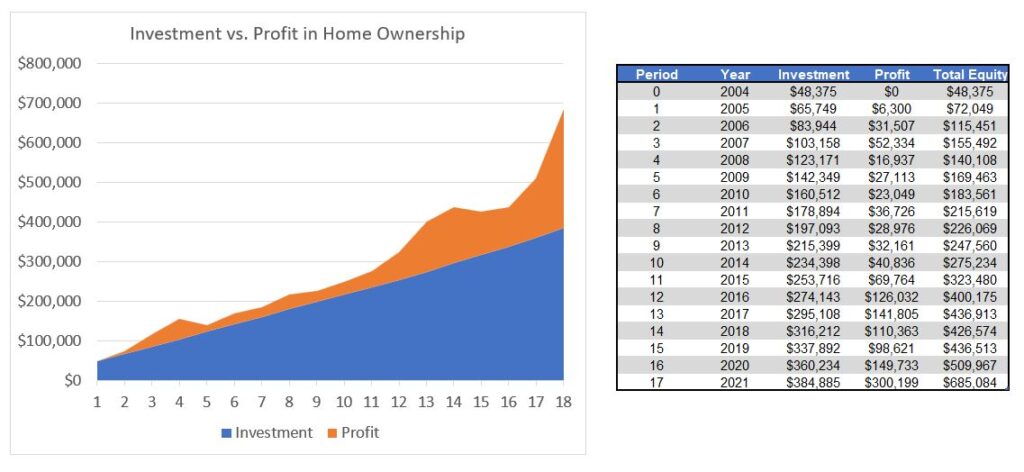

All of these factors result in:

- An annualized return on investment of 5.03%

- A total investment from 2004 to 2021 of $384,885

- The initial down payment plus all of the associated costs and principal paydown over the period

- A total unrealized profit of $300,199

- The equity value of the home, $685,084, minus the total investment, $384,885

- A total realized profit, after closing costs, of $261,939

Taking everything into account the returns on homeownership are lower than projected in the RBC chart. But the difference is not dramatic and does not consider the factors that make the stock market less attractive. Such as:

- You are taxed on those gains when you sell.

- You are taxed on the dividends you would have received along the way

- The volatility of the stock market is much greater than the housing market

- Investment management fees

The takeaway is that home ownership in Canada has been a good investment. A home acts as a forced savings vehicle, which has resulted in many homeowners experiencing the benefits of long term compounding. A primary factor in building long term wealth.