With personal finance, as with most of life, if you get the big things right you’re going to be okay.

Purchasing a home is a big thing, and messing it up can seriously set you back financially.

I’m not talking about timing your home purchase perfectly, though that would make a difference.

The best way to not get screwed when buying a home is…. Being able to afford the home you’re purchasing!

There’s a difference between the home purchase being a stretch and being totally ludicrous. Purchasing a home, particularly for the first time, is not a comfortable experience. There’s a lot of money on the line. You should feel nervous.

But there are steps to greatly reduce the chance of something like this happening

307-120 Harrison Garden, Willowdale

— Toronto & Southern Ontario Housing Smash (@TOHousingSmash) November 14, 2022

Sale falls through (?) In March, then WHAT THE F*** HAPPENED?

GEEEEEEEEEZ!#tocondos pic.twitter.com/p1e5r66sAi

I feel bad for whoever bought this because it’s probably someone who saved up diligently and maybe didn’t think through everything. Most people don’t and things are usually okay, but it wasn’t this time.

Assuming a 20% down payment here’s how the numbers roughly break down.

- $800,000 purchase price

- $160,000 down payment

- $640,000 mortgage

Then the home is sold $560,000

- Mortgage is mostly paid off, but there is still $80,000 in debt remaining. The lender can still go after the borrower for this amount even though the home is already sold!

In Canada most loans are “recourse loans” this means that if you sell a home for less than the value of the mortgage, the lender (bank, credit union, private lender etc) can legally go after the borrower for the remaining value of the debt that is unpaid.

In less than a year the seller lost their entire down payment, their condo and still owes the bank $80,000. This doesn’t even account for transaction fees or mortgage payments while they owned the condo.

In the words of Warren Buffett you should….

“Never risk what you have and need for what we don’t have and don’t need.”

Ol’ Uncle Warren (Buffett)

So, how do I avoid this when purchasing a home?

There’s only a few things that will get you in real trouble. Homeownership over the long term has been a good investment. But if you’re forced to sell in the short term that doesn’t matter. Consider whether

- You still make the payments if you or your partner lost their job

- The property has the ability to generate rental income to help reduce your payments

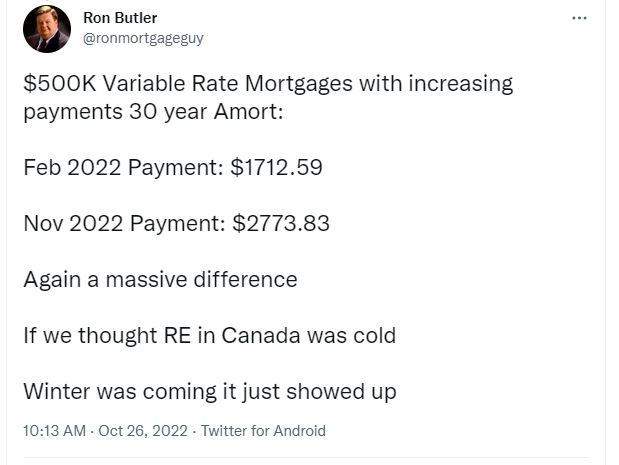

If you’re right on the edge of being able to afford a home, and you take a variable rate mortgage because “rates are going lower” or its “cheaper” you run the risk of being unable to service your mortgage payments and are forced to sell…

Don’t take a variable rate mortgage because you think “rates are going lower”

If you could predict the moves in the interest rate market why not open a trading account and trade fixed income futures? If you knew the direction of rates you could make an unbelievable amount of money trading on that information. You wouldn’t even need a mortgage on your house, or your 2nd, 3rd, 4th and 5th homes.

You might not get as low of a rate with a fixed rate, but you lock in some certainty. “For 5 years, until the term of this mortgage is up, my payment is $xxxx per month.” This will safeguard you from rising rates for the term of the mortgage, making you less likely to be a forced seller.

Don’t take a variable rate mortgage because it’s “cheaper”

Variable rate mortgages have lower rates because they are less risky for the lender. The reason they are less risky for the lender is because they are more risky for you. The lender can adjust the rates of the mortgage in lockstep with the Government of Canada rate.

If you chose a variable rate mortgage because you couldn’t afford the mortgage otherwise, that’s not a great reason. If you’re already stretched and rates go up it’s going to break you.

If you can afford mortgage payments with a fixed rate and plan for extra contingencies you can greatly reduce the risk that you’re a forced seller, aka getting screwed.