Valuations vs. Fundamentals

In the short run, the market is a voting machine, but in the long run, it is a weighing machine.

Benjamin Graham

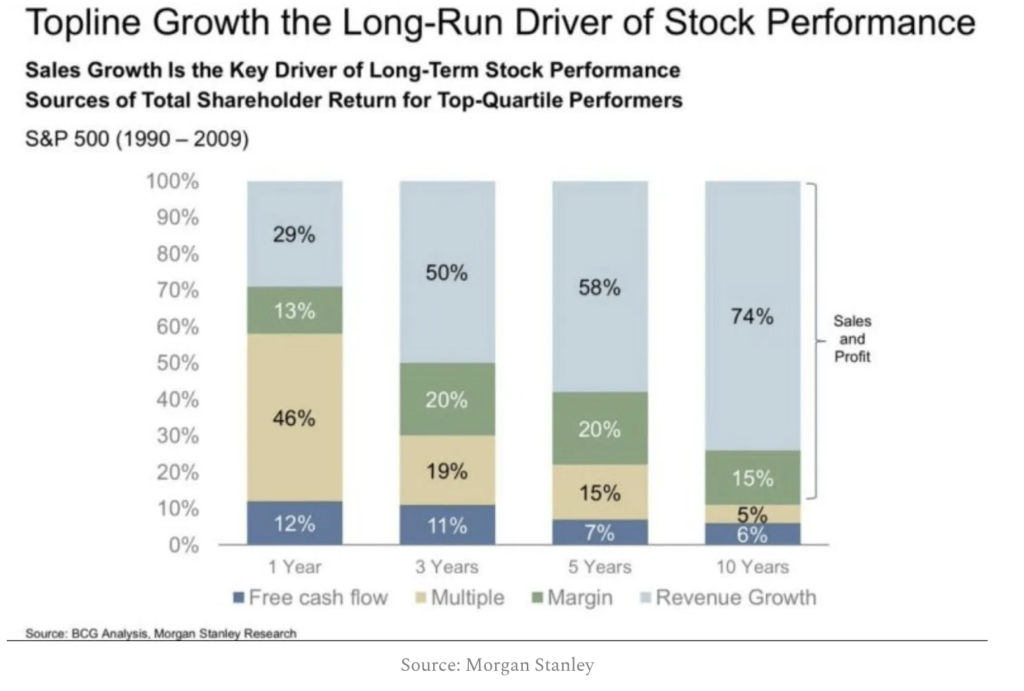

An oldie but a goodie. And this chart provided some data behind it

It’s pretty obvious that in the long term, the performance of stock will be determined by the growth of the business. Though in the short term, it doesn’t matter at all.

In the market wizards book, Steven Cohen references a rule of thumb that a stock’s return is:

- 1/3 The Overall Market

- 1/3 The Industry

- 1/3 The Individual Stock

I think this is a pretty good way to think about stocks. The short-term performance of a stock, good or bad, has more to do with general sentiment than anything else.

In the long term whether a company trades at a 10x or 15x multiple matters less. If they go from earning $5m to earning $50m the business is worth a lot more.

Rates Rise

The Bank of Canada raised rates again this week, by another 0.25%.

Mortgage rates and loans of all kinds are priced off of Government of Canada rates. It also impacts the rates you can earn on your savings and cash.

I bet the banks will have to budge a bit on their high-interest savings. But not as much as some would like. This article from 2022 highlighting the bank’s restriction of high-interest alternatives is still in place today.

Development Charges

Mike Moffat shared another great tweet on residential housing

There's one really obvious reason why not a lot of rental apartments get built in the GTA… pic.twitter.com/QvWIrENv4a

— Dr. Mike P. Moffatt 🇨🇦🏅🏅 (@MikePMoffatt) June 2, 2023

These charges definitely aren’t helping us get more affordable housing in the Great White North

A Sad Day

The Blunt Beancounter, one of the best Canadian Finance & Tax blogs, has announced his blog’s retirement.

If you have any interest in understanding the finer details of corporate tax planning his blog was indispensable. It opened my eyes to a number of solutions for business owner clients that I wouldn’t have otherwise been aware of.

From the Future Proof Desk

This week we wrote about your retirement income options if selling your home isn’t an option.