Canadian Apartments

Canadian Apartment properties (CAPREIT), Canada’s largest apartment REIT, released their most recent presentation last week and no surprise they are doing just fine.

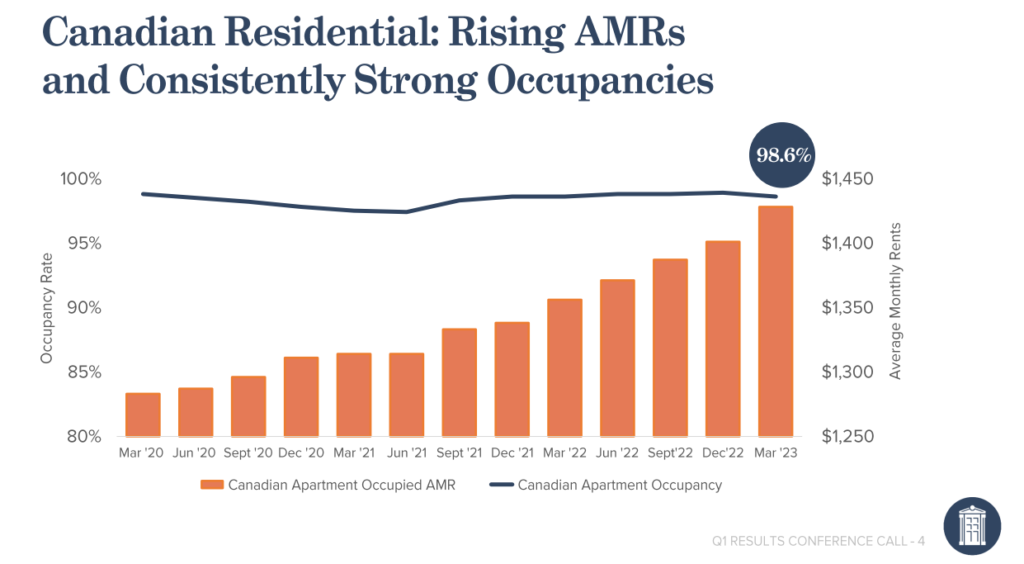

They report a number of figures, but the main point that sticks out is the consistently growing monthly rents they are reporting for their buildings (AMR – Average Monthly Rents)

And nobody is causing a fuss about paying those increased rents – you can see their occupancy holding steady at over 98%, meaning they only have 2 vacancies for every 100 units.

@MikePMoffatt put together a good thread on the lack of housing and had a good chart which shows the growth in population outpacing new housing developments. Ultimately if there is not enough places for people to live rents will increase, which benefits apartment owners.

Time for a thread that will make me unpopular. But I need to say it.

— Dr. Mike P. Moffatt 🇨🇦🏅🏅 (@MikePMoffatt) May 19, 2023

I see academics on here blame high rents on "financialization", "neoliberalism", "housing as an investment" etc etc. But *refuse* to acknowledge the single best source of rent increases in Ontario: academia.

CAPREIT have also been selling some of their older properties in favour for new ones. These properties were typically built decades ago and likely have some meaningful Capex coming (new roof, new HVAC) and they are happy to take their profits and invest them in new buildings with good bones (and no rent control on newer buildings!)

Nobody Has a TFSA

In a 2022 study done by BMO they shed some light on on Canadians’ knowledge of TFSAs

The most interesting point to me?

- While 73% knew that they should have a TFSA only 50% actually have a TFSA

It’s worth a read, you can find it here

Should you buy GICs?

I’ve been getting this question more and more.

And that would have been the trade to make in January of 2022 (which is easy to see with the benefit of hindsight). You can see this outlined in the following chart:

While that would have been nice to do the question now is should we be selling our stocks today in favour of guaranteed returns in high interest cash?

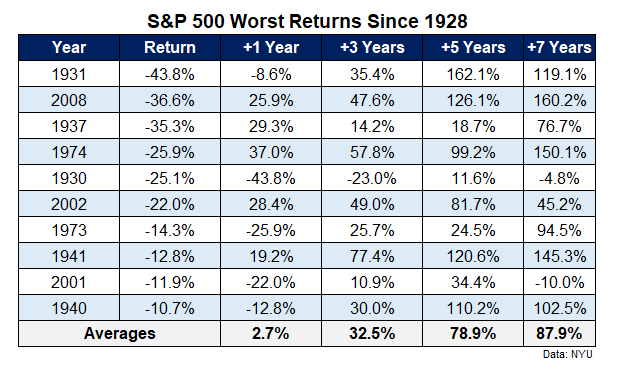

Ben Carlson wrote a good article about this at the start of the year (you can read it here), but the main takeaway is that markets do typically recover after big drawdowns:

This doesn’t guarantee things are going to turn rosy right away. But if you have a long enough time horizon and are focused on growth the stock market is still the place to do.

For retirees and savers drawing down their accounts the higher returns offered by GICs and other cash-like investments could be the place to be. You can get rates on $CAD in the 4% – 5% range, and $USD savings are even higher.

Some GICs are offered with even higher rates, but they’re usually promotion rates. A higher interest rate is paid for a short period of time at the beginning, but then the rate decrease to a normal range.