If you know you need life insurance.

- If you don’t know, read this

And if you know how much life insurance to get.

- If you don’t know, read this

The final question is which type of life insurance to get.

- If you don’t know this, read on

TLDR – Life Insurance Guide

Life Insurance Type

Cheap Term Insurance is appropriate in 99% of cases. Because it solves the problems of 99% of people.

If you’re a wealthy business owner, permanent insurance can be an option. But even then the use cases are quite niche.

If you’re working with a financial advisor you trust this would be a discussion to have with them to see if permanent insurance would make sense. 1If you’re looking for a number to define “wealthy” for this circumstance I would say $5m – $10m +

Life Insurance Costs

The cost of your insurance will vary depending on

- Your Age

- Your Health

If you’re young and healthy your insurance will be cheap.

If you’re old and unhealthy your insurance will be expensive. Or the insurance company might not provide coverage at all.

But in general, all insurance is “cheap” if you end up using it.

You’re paying hundreds or thousands of dollars per year, with a payout of hundreds of thousands or millions.

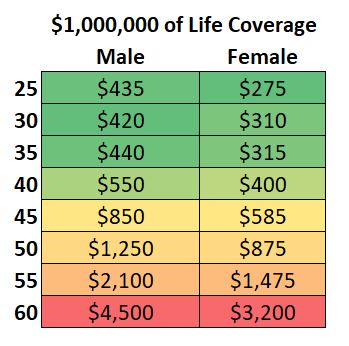

Here’s a breakdown of cheap term insurance costs from Compulife

If you walked away from this article you’d be in good shape.

But if you’re interested in more detail, read along….

What types of life insurance can you get?

There are two categories of insurance you can purchase

- Term Insurance

- Permanent Insurance

What is Term Life Insurance?

When you hear the word “term” with respect to insurance think “temporary”

Term insurance is temporary insurance. It expires after a pre-determined period of time.

When does my term insurance expire?

There are three common time frames for term insurance

- 5 years

- 10 years

- 20 years

Depending on the term you choose you will have life insurance coverage for that period. For a pre-determined price.

At the end of the term, the insurance company usually gives you the option to extend your coverage. But it will be at a higher cost.

At this time it’s worth determining

- Whether you still need insurance

- How much insurance do you need now compared to before

If you determine that you still need insurance it’s best to re-apply and check different providers costs.

What is Permanent Life Insurance?

Permanent insurance is the opposite of term insurance.

It is not temporary, it’s permanent.

Permanent insurance will last for as long as you live. Or in some cases as long as your spouse lives after you die.

Permanent insurance comes with three different sub-types

- Term to 100

- Whole Life

- Universal Life

For this article, the differences between these three sub-types do not matter. I’ve written a separate article on that.

What type of Life Insurance should I buy?

In the first article of this series, we talked about the three use cases for life insurance:

- Creating an estate

- Preserving an estate

- Equalizing an estate.

And depending on which of the use cases you solve with life insurance will determine which type of insurance you should purchase.

When should I use Term Life Insurance?

Term insurance would be used when the goal is to create an estate.

Since creating an estate is the most common use for insurance, term insurance is the most commonly purchased insurance.

Unless you’re in a niche circumstance2You are a wealthy business owner with excess funds in a corporation. Or there is a tax liability on your death that will impact your estate wishes., you should only consider term insurance.

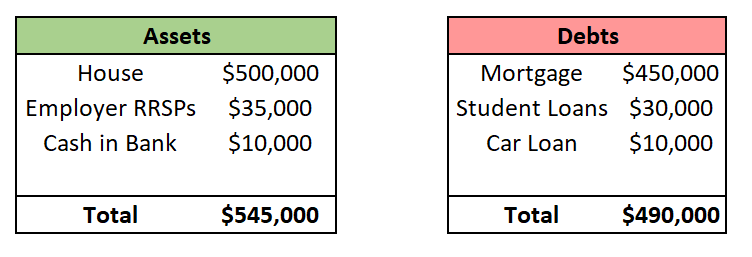

Joe & Sally, 38 & 37, are married with twin boys, they are 4 years old. They have the following assets and debts

Subtracing debts from assets gives us their total net worth of $55,000

This is a textbook case of needing insurance to create an estate.

While a $55,000 net worth is not nothing if either Sally or Joe passed away there would not be enough money to service the debt and take care of the kids.

There are methods to determine how much insurance you need, but let’s assume they each get $750,000 of life insurance coverage. At their ages, the cost would be minimal 3 and if either of them died the other could:

- Pay off the entire mortgage

- Pay off the student loans

- Pay off the car loan

- Have money set aside for childcare

This would put them in a much better financial position compared to not having insurance.

When should I use Permanent Life Insurance?

On the flip side, permanent insurance is used when the goal is to preserve or equalize an estate.

Since preserving or equalizing an estate are not common needs, permanent insurance is used much less than term insurance.

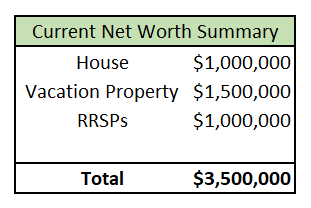

Jim & Jane, 75 and 77, have the following assets which they intend to pass on equally to their children Rob & Tom.

Based on these figures Rob & Tom each expect to receive $1.75m when their parents die.

Rob uses the cottage while Tom doesn’t care for the cottage. The family sits down and determines that Rob will buy the cottage with his share of the estate funds. Tom and his parents agree with this.

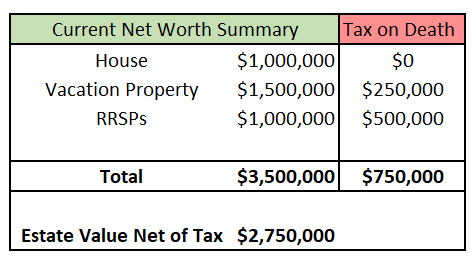

But the above net worth figures don’t take into account the tax payable when Jim & Jane pass away.

Now instead of Rob and Tom receiving $1.75m, as expected, they will actually receive $1.375m.

This is not a problem by itself, but the issue is that the cottage is valued at $1.5m, less than the $1.375m that Rob will be receiving. Meaning Rob cannot purchase the cottage as the family had planned.

There are two ways to solve this

- Rob could purchase $125,000 of life insurance on his parent’s lives. When they pass away Rob will receive his share of the estate, $1.375m, plus $125,000 from the life insurance policy. This would allow Rob to purchase the vacation property.

- Jim and Jane could purchase life insurance policies on themselves to cover Rob’s $125,000 shortfall. But to be fair to Tom, they would have to purchase an additional $125,000 in insurance so that Tom receives the same payout as Rob.

Costs of Term Life Insurance vs. Permanent Life Insurance

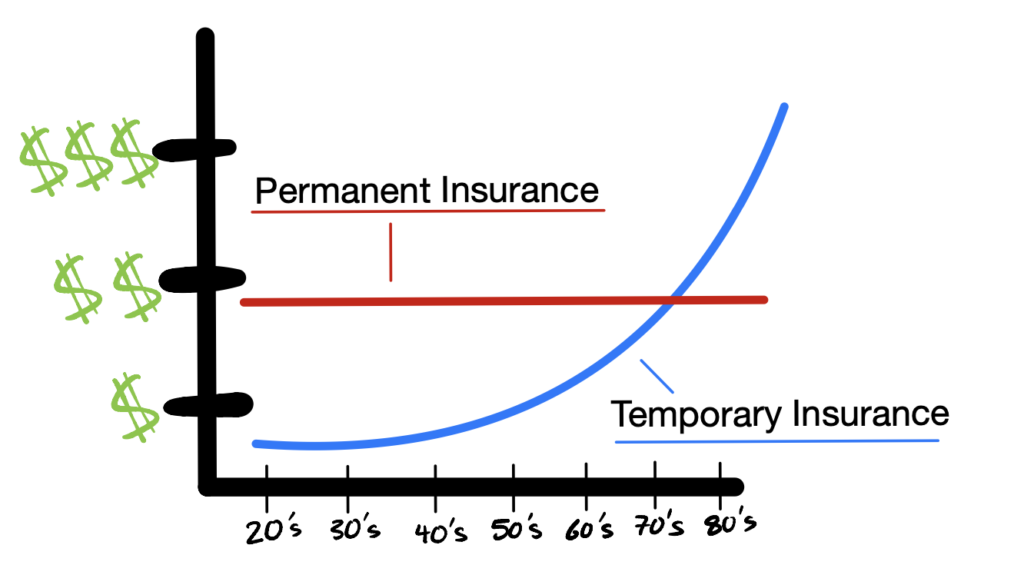

Term insurance is cheaper than permanent insurance most of the time.

The only time that changes is well past retirement age when the costs to insure you are very high. Because the probability that you die in the near term is also high.

And this is why most people need term insurance, not permanent insurance.

Because the only time in your life when permanent insurance is cheaper than temporary insurance is when you need insurance the least.3For the astute readers out there, you may note that the reason permanent insurance is “cheaper” later in life is that it was more expensive earlier in life. Insurance companies aren’t doing this for free!

You have life insurance when you’re young, in debt and the kids are young. That is when things could go seriously wrong financially if you died prematurely.

If you live a full life, you’ll have accumulated more assets, and your kids will have more assets.

Your death probably wouldn’t financially impact anyone in a big way.

And therefore life insurance becomes less valuable the older, or more specifically, the more financially secure you are.4And financial security correlates strongly with age