We wrote a separate article to help you determine whether you need life insurance or not.

And if you’re here I can assume you do.

Now that you know you need life insurance lets figure out how much you need.

The amount of insurance will depend on two primary factors

- The amount of debt you have

- The amount of income a surviving spouse would need

This is not an exact science.

Instead, we can use these figures to get a general “feel” for how much life insurance would make sense for you.

At a minimum, the amount of insurance you purchase should cover all your debt.

But it should also act as an income replacement for a period of time.

Using Insurance to Cover Your Debt

This is as simple as it sounds.

Tally up all your outstanding debt.

This is the minimum amount of life insurance coverage you should have.

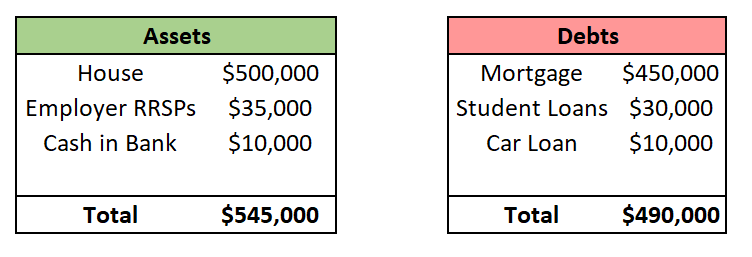

Let’s go back to our earlier example of Joe & Sally from our initial article

Their total debts add up to $490,000

So, at a minimum, we’d want to make sure that Joe had $490,000 of life insurance. And Sally had $490,000 of life insurance.

Easy, right?

Now let’s get into the more complex part.

Replacing Your Income

If you die, you’re no longer earning income.

Previously that income was used to support your family. And your death won’t stop your family’s need for income.

That means in addition to covering your debts, you also want to have additional insurance to make up for the income that you would have been earning.

We can calculate the amount of insurance required to replace your income using two methods

- Back of the Envelope Method

- Present Valuation Calculation (Fancy Finance Method)

Back of the Envelope Calculation

If Joe was earning $70,000 per year that means

- 5 years of lost income is worth $350,000

- 10 years of lost income is worth $700,000

This is a simple method. And it works.

Technically it can result in you purchasing a bit more insurance than you need.

But if cost is not a concern, then this method works well.

And in any case, most people are underinsured. So having a little extra insurance doesn’t hurt.

Present Value Calculation

This is where we get to the world of high finance.

Fancy formulas and complex calculations.

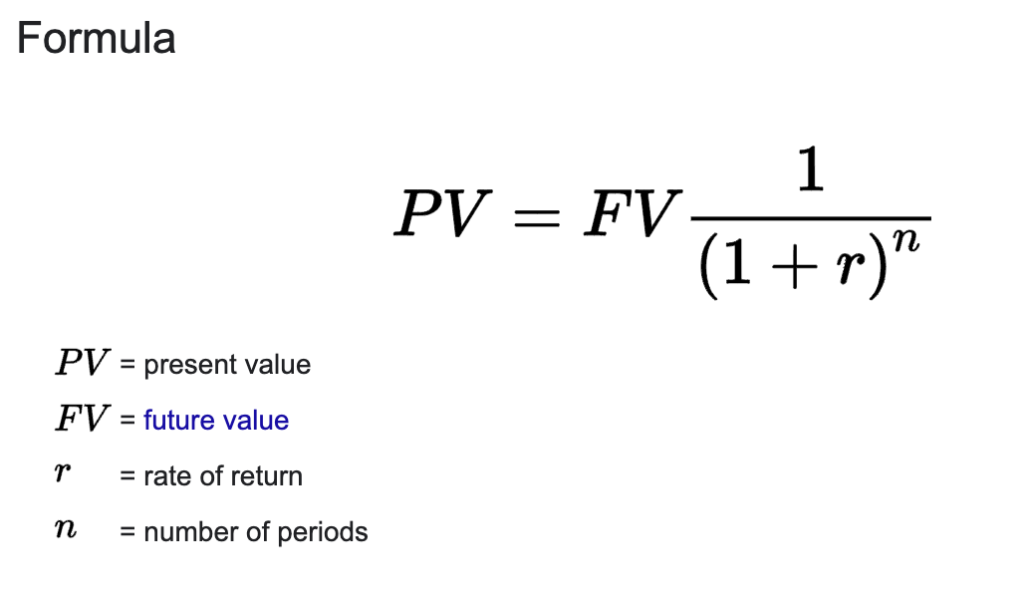

The Present Value formula is no exception

So, what does this formula mean?

Without getting into too much detail, if you receive a lump sum of money like you do with insurance, that money can earn interest.

And because that money can earn interest you don’t need $700,000 to pay out $70,000 for 10 years. You need a little less.

This is what they call the “time value of money”

In practical terms, we use the above present value formula and determine exactly how much money we’d need today to provide an income for a given period of time.

Let’s see what the formula spits out for us

- Present Value (PV) = ?

- This is the value we are trying to solve, how much money from insurance we need today

- n = the number of years we want income for

- 5 years, 10 years, etc.

- i = interest rate we are earning on the money

- let’s use 5%, we can earn that in GICs today

- Future Value (FV) = 0

- We don’t want to have money left over after providing the income

- We don’t want to have money left over after providing the income

Based on these inputs

- $70,000 of income for 5 years would require $303,000

- $70,000 for 10 years would require $540,000

Using the present value method will always result in a lower amount of insurance compared to the bank-of-the-envelope method1Unless interest rates are negative, which is unlikely. Though it did happen in certain parts of the world in the early 2020s

Don’t forget about childcare costs!

Something that’s often forgotten with insurance planning is the cost of child-care if one spouse is at home with the kids.

If that spouse passed away alternative arrangements for the kids would need to be made. You’d either need to

- Pay for Childcare

- Cut your work hours to facilitate the kids

- Both

This cost can be quite substantial, and it needs to be considered. Just like replacing income.

Putting it all together

After you’ve figured out how much insurance you need to cover your debts and replace your income you add the two amounts together and there’s your answer!

It’s common for each spouse to have different amounts of insurance so don’t worry if that’s the case for you too.

An Example with Joe & Sally

Joe’s Insurance Needs

- To cover outstanding debts we need $490,000 of insurance coverage

- Joe’s salary is $70,000 and they’d want to replace his income for 10 years

- Back-of-the-envelope calculation $700,000

- Present Value calculation $540,000

This means that Joe should have somewhere between $1,030,000 and $1,190,000 of insurance.

Sally’s Insurance Needs

- To cover outstanding debts we need $490,000 of insurance coverage

- We estimate that replacing Sally’s cost of childcare would be $35,000 per year. And we’d want to cover this cost for 10 years

- Back-of-the-envelope calculation $350,000

- Present Value calculation $270,000

This means that Sally should have somewhere between $760,000 and $840,000 of insurance

Most people think this figure sounds high. But they are discounting their future earnings power they would likely end up at these figures given enough time.

And that’s everything required to determine your insurance needs!

If you do this full exercise you’ll be in excellent shape in the case of a tragic life event.