Life insurance is something that comes up a bit later in life.

Most people know life insurance exists, but they don’t know what the use cases are.

In this article we’re going to explain

- When should you get life insurance?

- What is life insurance for?

- And give you some common examples of how life insurance works in the real world.

When should I get life insurance?

For most people, life insurance shouldn’t be considered until :

- You purchase a home with a mortgage

- You have kids

- Both

Why do these life events make insurance worthwhile?

Up until these points, there is little financial impact of you dying.

If you’re 25, with no kids and no mortgage your death will be sad.

But others won’t be financially ruined as a result of your death.

If you’re 38 with a spouse, two young kids, and a big mortgage, you need insurance.

Your death would put a huge financial strain on your family.

What is Life Insurance For?

There are three reasons to have life insurance

- To Create an Estate

- To Preserve an Estate

- To Equalize an Estate

Creating an estate is the most common reason to buy life insurance.

While preserving and equalizing an estate is less common, it is very common for business owners, real estate investors, and farmers since the assets they own are less liquid compared to traditional retirement assets. 1Most retirement assets would consist of stocks, bonds, mutual funds, and GICs

If I had to guess2 This is entirely based on gut feeling. I have no research to support this. Over 80% of use cases for insurance would be to create an estate while the remaining 20% would be to preserve and equalize estates.

Let’s get into what each of these uses mean

Creating an Estate

Creating an estate refers to a situation where your children are young or you have any large amounts of debt. Or Both.

If you passed away today the financial impact on your family would be large. This is because you haven’t had the chance to build up a big enough nest egg to weather financial storms.

Purchasing insurance in this scenario will provide sufficient assets for your family so that life can carry on. The mortgage can be paid and the kids can have post-secondary education paid for.

Scott Galloway has a great quote in this video. Jump to 52 minutes.

If I die, I wanted my family to be sad. But I didn’t want them to be scared.

Scott Galloway

A Common Example – Creating an Estate

To illustrate this point further here’s an example.

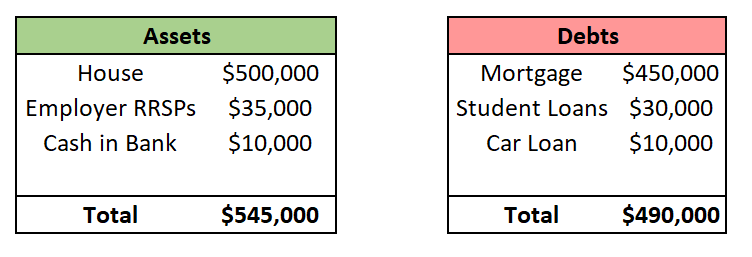

Joe & Sally, 38 & 37, are married with twin boys, they are 4 years old. They have the following assets and debts

Subtracing debts from assets gives us their total net worth of $55,000

This is a textbook case of needing insurance to create an estate.

While a $55,000 net worth is not nothing if either Sally or Joe passed away there would not be enough money to service the debt and take care of the kids.

There are methods to determine how much insurance you need, but let’s assume they each get $750,000 of life insurance coverage. At their ages, the cost would be minimal 3$50 to $100 per month and if either of them died the other could:

- Pay off the entire mortgage

- Pay off the student loans

- Pay off the car loan

- Have money set aside for childcare

This would put them in a much better financial position compared to not having insurance.

Preserve an Estate

Insurance strategies to preserve estates are common with vacation properties and family businesses where tax liabilities can force the family to sell assets they otherwise would not sell.

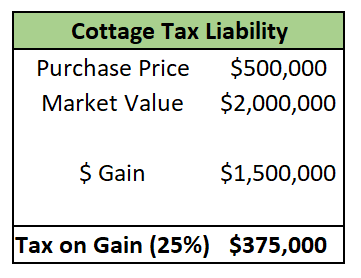

The simplest example would be a vacation property.

It’s no surprise that Canadian real estate values have increased dramatically over the last few decades.

This can result in cottages where the market value far exceeds the purchase price. And on that gain, you can expect to pay ~ 25% in taxes. 4Assuming top marginal tax bracket of ~ 50%. Only 50% of capital gains are reported as income. 50% x 50% = 25%

Remember, this tax is triggered when the person(s) who own the cottage dies regardless of whether the cottage is sold or not.

If there is not $375,000 of cash or other investments that can be accessed to pay this tax bill then the cottage may need to be sold to cover the tax bill.

This is a circumstance where having insurance on the lives of the cottage owners would be valuable. It provides liquid cash at the time of their death, which could be used to pay this tax.

Equalize an Estate

Similar to preserving an estate, equalizing an estate is less common.

Scenarios, where an estate needs to be equalized, can occur when parents want to distribute their assets to their kids equally, but there are certain assets that one child wants and the others do not. Or there are assets that are not easily divided.5Such as a business, real estate, or land.

The need for insurance to equalize an estate arises for similar reasons as preserving an estate. There is not sufficient liquidity6liquidity means easily accessible cash

A Common Example – Equalizing an Estate

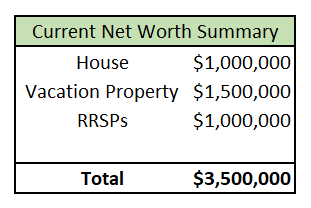

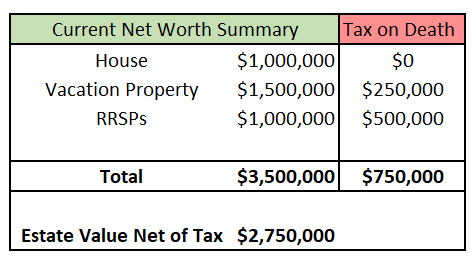

Jim & Jane, 75 and 77, have the following assets which they intend to pass on equally to their children Rob & Tom.

Based on these figures Rob & Tom each expect to receive $1.75m when their parents die.

Rob uses the cottage while Tom doesn’t care for the cottage. The family sits down and determines that Rob will buy the cottage with his share of the estate funds. Tom and his parents agree with this.

But the above net worth figures don’t take into account the tax payable when Jim & Jane pass away.

Now instead of Rob and Tom receiving $1.75m, as expected, they will actually receive $1.375m.

This is not a problem by itself, but the issue is that the cottage is valued at $1.5m, less than the $1.375m that Rob will be receiving. Meaning Rob cannot purchase the cottage as the family had planned.

There are two ways to solve this

- Rob could purchase $125,000 of life insurance on his parent’s lives. When they pass away Rob will receive his share of the estate, $1.375m, plus $125,000 from the life insurance policy. This would allow Rob to purchase the vacation property.

- Jim and Jane could purchase life insurance policies on themselves to cover Rob’s $125,000 shortfall. But to be fair to Tom, they would have to purchase an additional $125,000 in insurance so that Tom receives the same payout as Rob.