I had a client ask me this question for the first time.

It was such an obvious question, but I have never been asked it before.

It was such an obvious question, that I didn’t know how to answer it.

I answered “As much as you can”, but afterward I realized that wasn’t a very good answer.

It’s not that the answer is wrong, it’s not. You should be saving as much as you can, especially in your 20s and 30s. It sets you up for a more comfortable life down the road.

But I’m not sure that’s what she was asking. I guess that she wanted to know

- Am I saving enough?

- Should I be saving more?

But it got me thinking – what amount of different monthly savings result in different amounts in retirement

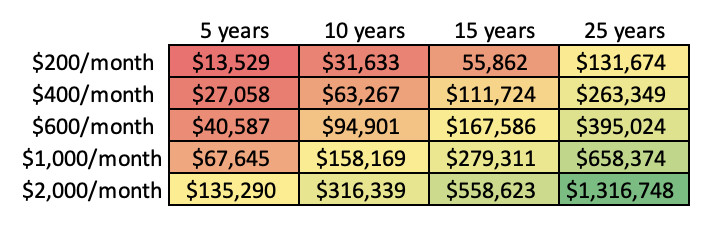

Using an average return of 6% per year (in line with a stock & bond portfolio), here’s how much you can expect to have over 5, 10, 15, and 25 years.

For most people, there is not a clear takeaway from an image like this.

Most would be comfortable with $1,000,000 tucked away in addition to their home equity, government benefits, and other forms of income.

But it’s not clear if having $250,000 is enough, or $350,000, or $150,000.

And the answer to that question can not be answered by simple retirement rules of thumb. It depends on your specific situation.

What I have noticed though, is people have more money saved up than they expect. They are “saving in disguise”

Savings in Disguise

There are a few common ways that people are saving for their retirement without even thinking about it.

- Contributing to CPP

- YMPE is ~ $66,000 and contributions are ~ $4,700 per year, so if you are earning this much income or more, you’re already contributing ~ $400 per month to CPP

- These are contributions into CPP’s pension plan which turn into retirement income

- If you receive the average amount of ~ $700 per month in CPP at a 5% discount rate that’s worth ~ $168,000 in retirement

- Mortgage Payments

- Your mortgage payment is made up of principal and interest. The interest payment is an expense, but the principal payment is savings to you.

- If you’ve got a $3,000 mortgage payment you could be paying $1,000 of that in principal. Even though those savings are in your home they’re still savings

- Employer RRSP Matches

- You’ve got to come up with the original amount. But employers that will match your RRSP contributions allow you to increase your savings

- i.e. if the company matches up to $6,000 in RRSP contribution a $6,000 RRSP contribution will result in an additional $6,000 in savings. The equivalent of $500 per month becoming $1,000

While it may not seem like much, a single one of these strategies is equivalent to saving $400 – $1,000 per month.

If you’re making use of multiple strategies you could be in the $1,000 – $2,000 per month range. All while feeling like there’s no money left at the end of the month.

It’s important to feel comfortable about having “money in the bank”, but you’re probably saving more than you think.