“Working” during retirement seems to defeat the whole purpose of retiring in the first place.

But in my experience, people have had success keeping one foot in the working world.

It gives them a sense of purpose and extra spending money while still being flexible enough to do what they want in retirement.

What may not be obvious to people is how valuable their part-time income in retirement is.

How Valuable is Part-Time Work During Retirement?

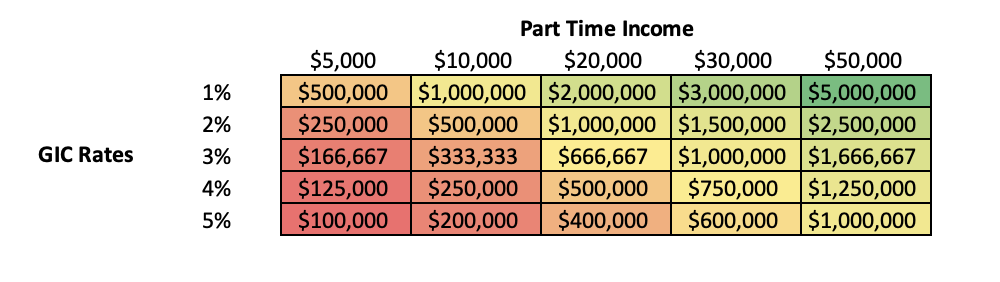

To assign a financial value to part-time work we must answer the following question:

- How much in retirement savings would I need to produce the same amount of income from working?

To answer this question you need two pieces of information:

- Your part-time income

- Risk-free interest rate

- The interest you can earn in risk-free investments, like GICs or savings accounts

Then you divide the 1st number by the 2nd number.

Value of Part-Time Job = Income Earned / Risk-Free Interest Rate

For example…

- If you could earn $10,000 in income, and purchase a GIC at 4% your part-time job is equivalent to $250,000 in retirement assets

- If you could earn $30,000 in income, and purchase a GIC at 3% your part-time job is equivalent to $1,000,000 in retirement assets

Obviously the “value of your part-time job” is not something you can access like cash in a bank account.

Rather, I am trying to communicate how valuable having a part-time job can be for your retirement.

The income produced from a part-time job, while it may not seem like much, is equivalent to a large amount of retirement savings.

The lower your income is, the less financially valuable your part-time job is. This is pretty obvious

But what’s less obvious is that the higher the risk-free rate (or GIC rates) are the lower the financial value of your job is.

This is because when interest rates are high it requires less retirement assets to produce the same income compared to when interest rates are low.

- $500,000 earning 2% = $10,000 in income

- $200,000 earning 5% = $10,000 in income

All else equal, low interest rates make your income more valuable. And high interest rates make it less valuable.