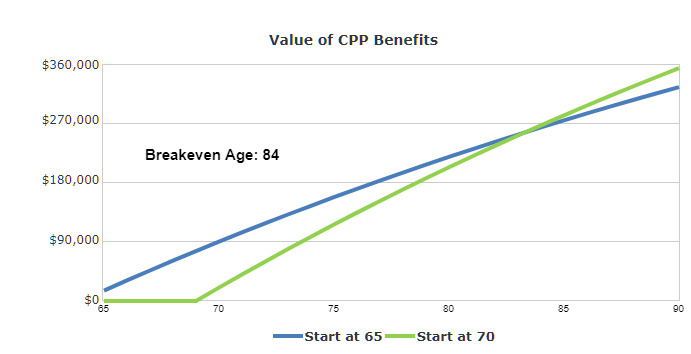

When it comes to planning for retirement, one critical decision many Canadians grapple with is when to start collecting the Canada Pension Plan (CPP). While you’re eligible to start receiving these benefits as early as age 60, there are compelling reasons to consider delaying CPP to age 70.

Let’s take a step further into understanding why delaying CPP might be the right move for your retirement plan.

Increased Monthly Benefit

Delaying the start of your Canada Pension Plan (CPP) benefits is one of the most effective strategies for increasing your retirement income.

By delaying CPP past age 65, you’ll receive an increased monthly benefit at retirement age.

Your CPP benefit increases by 0.7% for each month you delay taking your CPP after age 65. This is equivalent to 8.4% each year you delay CPP after age 65. And by delaying CPP to age 70 your benefit will increase by 42%

The average CPP payment in 2023 is $760 per month. But by delaying CPP to age 70 this could increase to $1,079 per month.

If you are concerned about the income you’ll have in retirement then delaying CPP is a surefire way to increase the amount of income you’ll be receiving.

But you will have to figure out how to bridge the gap until age 70. Whether that’s continuing to work or drawing down on your investments. It’s always a good idea to talk with a financial advisor to understand your specific situation and make recommendations on these decisions.

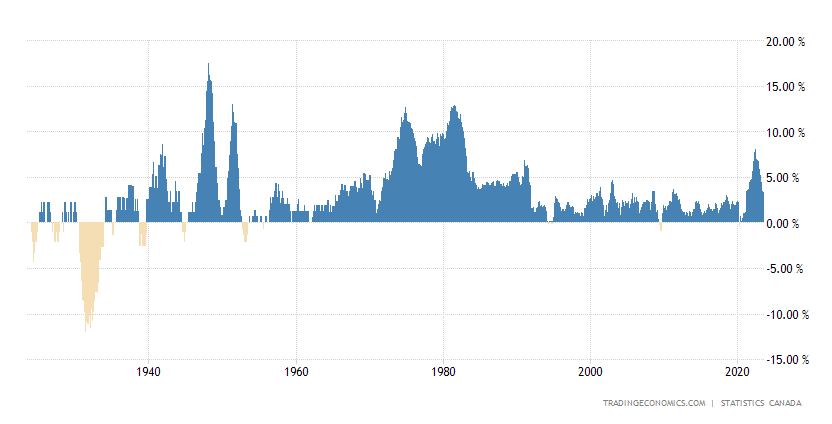

Protect Against Inflation

Delaying CPP until age 70 can be a great way to protect against inflation in retirement.

Inflation has historically averaged 2% – 3%, but the increase in CPP by delaying your payments is 8.4%.

This is well in excess of inflation. This means your purchasing power of CPP (what you can buy with the money) will be even more valuable.

Once you begin to take CPP it is also indexed with inflation. So your pension will continue to increase alongside (but not in excess) of inflation well into retirement.

Save on Taxes

Delaying CPP can be a great option for those who expect to receive a lower income in retirement than they do currently.

This is because in Canada we have marginal tax brackets. Meaning as you earn more income you’ll pay a higher percentage of your income as tax. But it works in reverse too, the lower your income the less tax you’ll pay as a percentage of your income.

In Ontario, someone earning $75,000 is at a ~ 30% marginal tax rate. For each additional dollar they earn they pay 30 cents in tax. If this person started taking CPP while earning employment income they would pay 30% of their CPP as tax.

Usually, while you’re working you want to delay CPP benefits for this reason. The benefits will increase and when you stop working you’ll be able to pay less tax on your CPP.

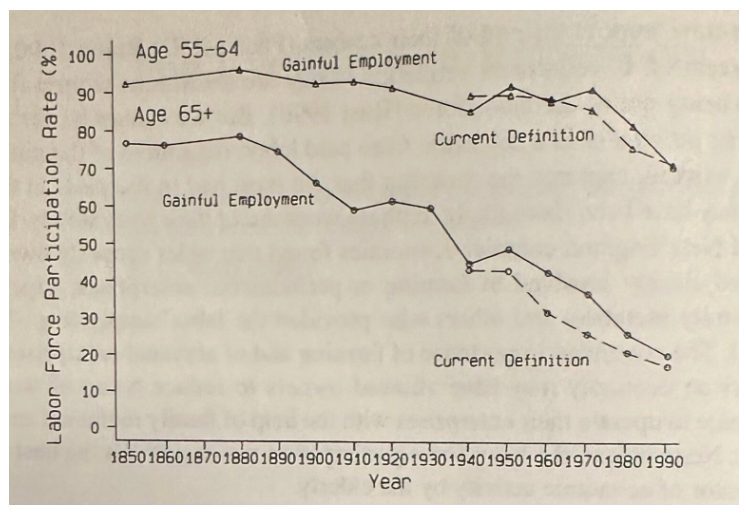

Reduce Longevity Risk

Longevity risk is the risk of living so long after retirement that you go through your savings too soon.

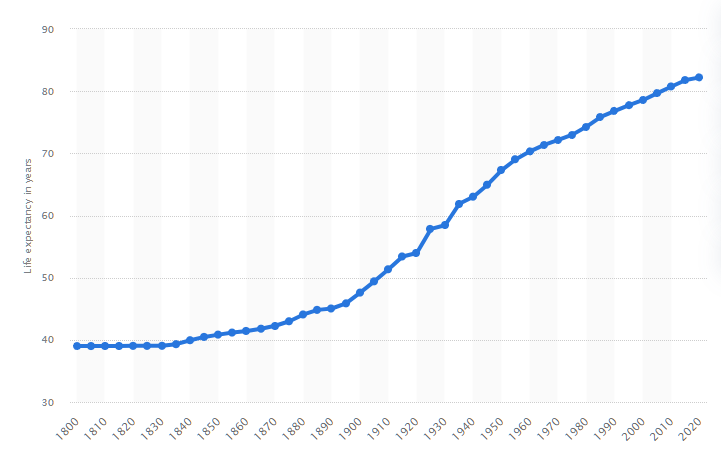

This wasn’t much of an issue in the past, but retirement has changed. Take a look at this chart from A Wealth of Common Sense

In 1950 half of people age 65 and older were still working. You can see that figure drop down to ~ 20% by 1990. I’m sure the percentage is even lower now.

In addition, Canadians now have much longer life expectancies. The life expectancy in 1950 was 70 years old.

Retirement as we think about it today was not common. People didn’t need to plan for longevity risk because shortly after they stopped working they would have passed away.

By delaying your CPP to age 70 you’re increasing your expected retirement benefit, and at the same time reducing the risk that you’ll outlive your funds.

Summary

Whether or not you delay CPP to age 70 is not a black-and-white decision.

It’s dependent on a number of factors and is different for every person considering the decision.

The best you can hope for is weighing out the odds and making a decision that best serves for financial needs and goals.