Canada Pension Plan (CPP) is an important part of most Canadian’s retirement income.

In this article, I cover everything you’ll need to know about CPP.

If you have a specific question, you can reference the table of contents below.

How much could I receive from CPP?

In 2023 you can expect to receive the following amounts from CPP if taken at age 65.

- Average CPP Received: $760 per month

- Maximum CPP Received: $1,306 per month

But these are just averages. The amount you will receive depends on

- Your age when you take CPP

- How much you have contributed to CPP in your working years

How can I find out how much CPP I will be receiving?

There are three ways to find out how much CPP you could receive

My Service Canada Account

If you have a My Service Canada account you can see your expected CPP benefit online.

If you have a My Service Canada Account this is the easiest option to find out how much you could receive from CPP.

Contact Canada Pension Plan

You can directly contact the Canada Pension Plan by phone or by mail.

If you do not have a My Service account this is your best option to find out how much you could receive from CPP.

You may require information to verify your identity, such as birthdate, SIN #, or other identifying information.

Using the Online CPP Calculator

The online CPP Calculator can be found here

This can be an effective tool, but it requires that you have your “CPP Statement of Contributions”

The CPP Statement of Contributions is a history of all your contributions made to the Canada Pension Plan.

It can be found online through your My Service Canada Account, or requested by mail.

How do I apply to begin receiving my CPP benefits?

There are two ways you can fill out an application to begin receiving your benefits.

- My Service Canada

Canada.ca has step-by-step instructions for both options

When can I begin receiving CPP?

The earliest age you can receive CPP is 60 years old. You will have to apply to begin receiving CPP.

The standard age to begin taking CPP is age 65. But you will still have to apply to begin receiving CPP.

And the latest you can begin receiving CPP is at age 70. At this point, you will be automatically enrolled in CPP and will begin receiving monthly payments.

Does the Amount of CPP I receive change depending on the age I take CPP?

Yes, depending on the age you begin receiving CPP the amount you receive will change.

Age 65 is the standard age to begin taking CPP.

What happens if I take CPP before age 65?

You can take CPP at any point after age 60.

But if you take it before age 65 your monthly CPP payments will be reduced by 0.6% per month multiplied by the number of months before you turn 65. On an annual basis, this means CPP is reduced by 7.2% for each year you take it before 65.

For example, if your CPP benefit would be $800 per month at age 65, but you begin receiving CPP when you are 63 the CPP benefit will be reduced by 14.4%.

Instead of receiving $800/month, you would receive $684/month.

- Age 65 – Age 63 = 2 years

- 2 years = 24 months

- 24 months x 0.6% = 14.4%

- $800/month x 85.6% = $684/month

But just because you will receive less from CPP if you take it before age 65 doesn’t mean you shouldn’t do it.

There are benefits (and drawbacks) to taking CPP early. (link to article)

What happens if I take CPP after age 65?

When you turn 65 you will not automatically begin receiving CPP. You will need to apply for it.

If you delay taking CPP after age 65 your monthly CPP payments will be increased by 0.7% per month multiplied by the number of months after you turn 65. On an annual basis, this means CPP is increased by 8.4% for each year you take it after 65.

For example, if your CPP benefit would be $800 per month at age 65, but delay receiving CPP until age 68 your CPP benefit will be increased by 25.2%

Instead of receiving $800/month, you would receive $1001/month.

- Age 68 – Age 65 = 3 years

- 3 years = 36 months

- 36 months x 0.7% = 25.2%

- $800/month x 125.2% = $1001/month

But just because you will receive more from CPP if you take it after age 65 doesn’t mean you shouldn’t do it.

There are benefits (and drawbacks) to taking CPP late. (link to article)

Does CPP increase alongside the cost of living?

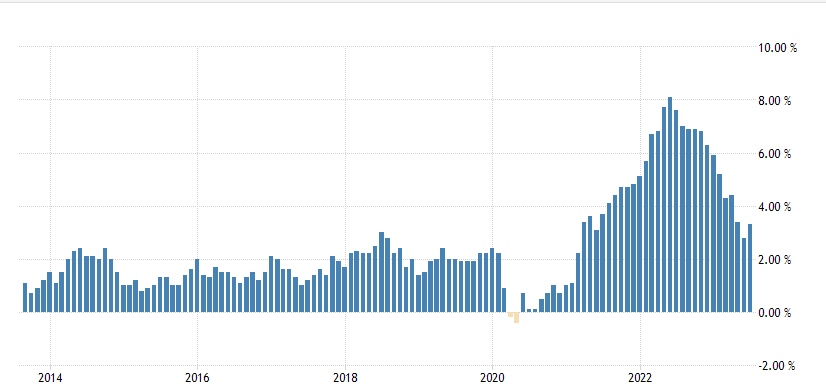

CPP is indexed to inflation, specifically the Consumer Price Index. As the cost of living increases the amount of money you receive from CPP also increases.

Inflation is typically 2% – 3% annually meaning your CPP benefits will automatically increase by the same amount each year.

Though, it is not written in stone that inflation will average 2% – 3% in the future. In 2022 inflation was much higher than that

When are the CPP payment dates?

CPP payments are made on a monthly basis. The payment dates can change slightly each year, but the Canadian government will always publish the payment dates for the upcoming year in advance.

The CPP payment dates for 2023 are:

- January 27, 2023

- February 24, 2023

- March 29, 2023

- April 26, 2023

- May 29, 2023

- June 28, 2023

- July 27, 2023

- August 29, 2023

- September 27, 2023

- October 27, 2023

- November 28, 2023

- December 20, 2023

These dates can also be found on the Government of Canada’s website

Are CPP and OAS the same thing?

No.

CPP stands for the Canadian Pension Plan. And the benefit you’re receiving CPP because you contributed to the plan during your working years.

OAS stands for Old Age Security. It is a separate benefit that Canadians can receive.

You can learn more about OAS here.

Can you receive CPP and OAS at the same time?

Yes, you can receive CPP and OAS at the same time.

They are separate benefits.

Can CPP be clawed back?

No CPP cannot be clawed back.

However, OAS can be clawed back.

You can learn more about how to avoid OAS clawback here.

Do all Canadians qualify for CPP

To qualify for CPP you must meet two requirements

- You must be at least 60 years old

- You must have made at least one valid contribution to the CPP