A picture is worth a thousand words. The phrase couldn’t be more true with this tweet about housing in the GTA

NIMBY + hardcore environmentalism + high immigration = biggest housing shortage in the world. Dilapidated shacks selling for 7 figs in city, w/ empty green space around it. Protected "green belt" surrounds Toronto, residential development illegal, thus sprawl = impossible. pic.twitter.com/TYabGx8L9X

— Jesse Livermore (@Jesse_Livermore) June 5, 2023

There is no urban sprawl. But we are beginning to see building come up on the north end of the lake which is a positive.

Trying too Hard

In investing it’s hard to avoid “deking yourself out” or scoring own goals.

Most of the time, a simple approach is best.

I’ve read this article many times, but it is an excellent read on keeping your investment process simple. And how to avoid trying too hard

Oil Stocks vs. Oil

Being Canadian the oil two industries I watch with interest are

- Oil & Gas

- Real Estate

Surprise, Surprise….

I don’t think I have any particular edge in investing in these companies. But I do enjoy the commentary around them.

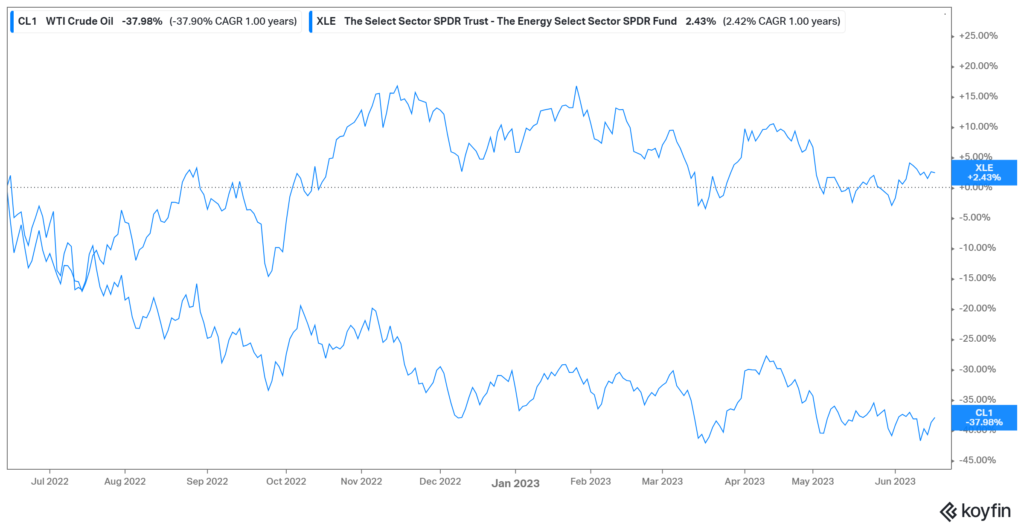

Normally oil (the commodity) and oil stocks move similarly. But over the last year there’s been a large divergence. Oil stocks have been flat while the commodity is down 40%.

The general consensus is that oil has traded down in anticipation of a recession.

Whether that will happen, I don’t know. But there are also many compelling arguments that we may not have as much oil as we need in the near term.

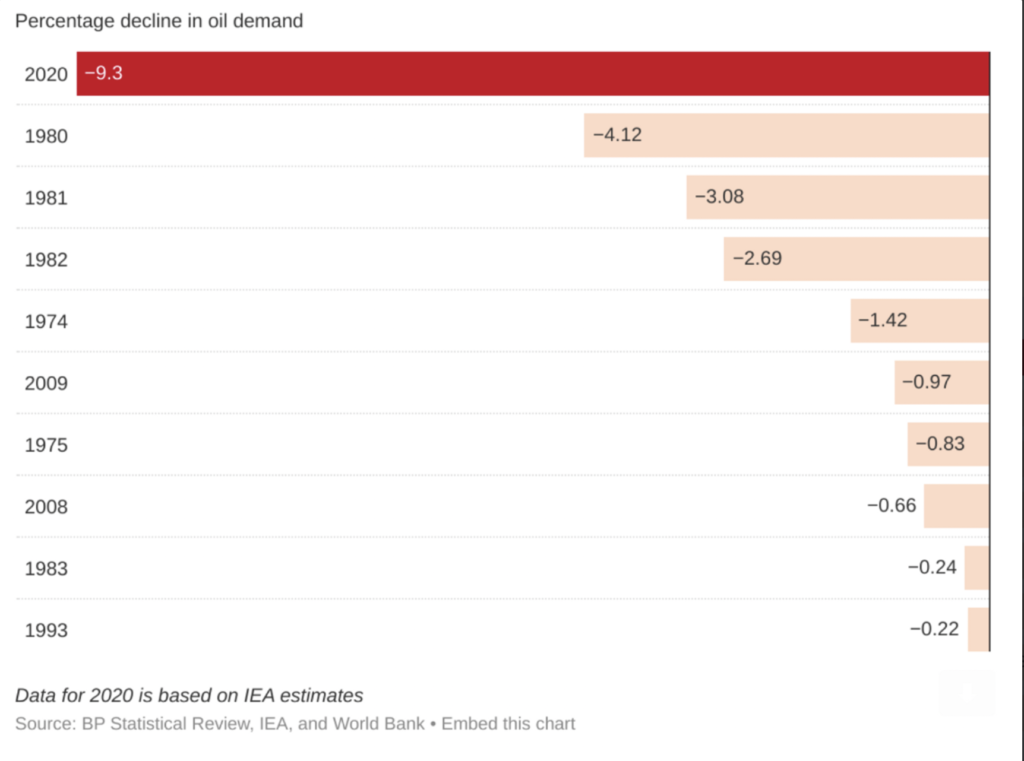

Oil demand does decrease during a recession. But at the height of COVID when everything was locked down oil demand only decreased by 9.3%.

The whole world was shut down and we went from consuming 100m barrels/day to 90m barrels/day.

Crazy how dependent we are on the stuff