People think there’s some sort of magic dial their investment manager can turn.

“The investors want a higher return!”

“No problem, I’ll just dial up the risk knob and we should be up and running!”

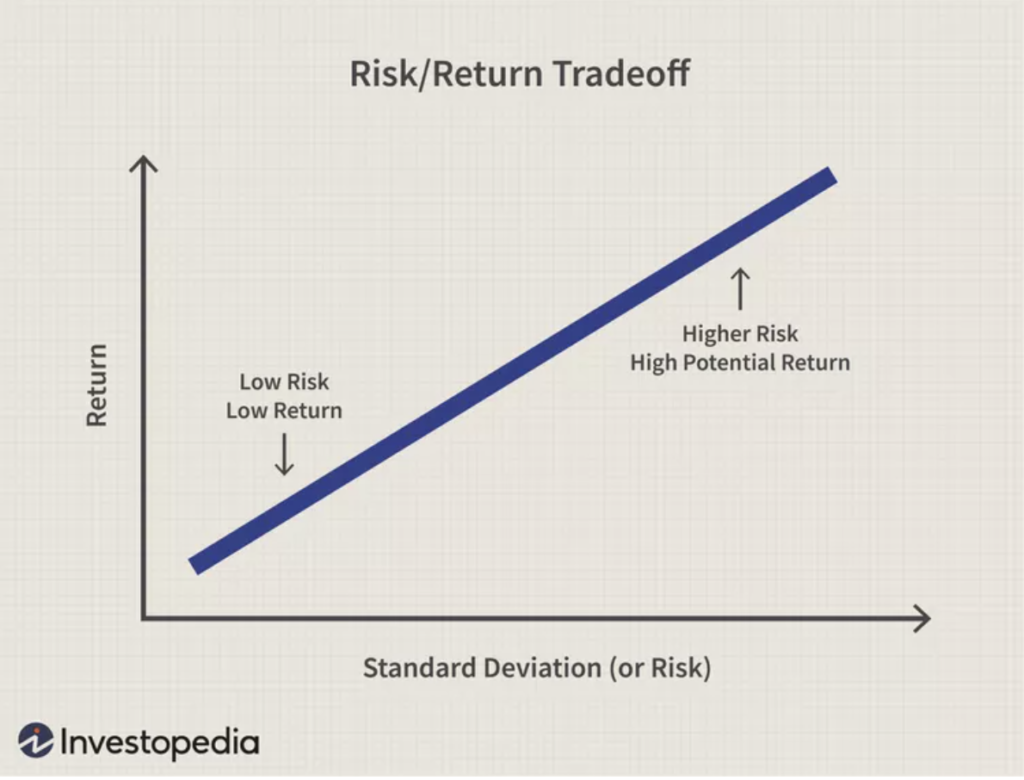

They think there is a linear relationship, a 1:1 ratio, between taking more risk and earning a higher rate of return.

WROOONG!!!

Howard Marks says it perfectly

If riskier investments could be counted on to produce higher returns. They wouldn’t be riskier.

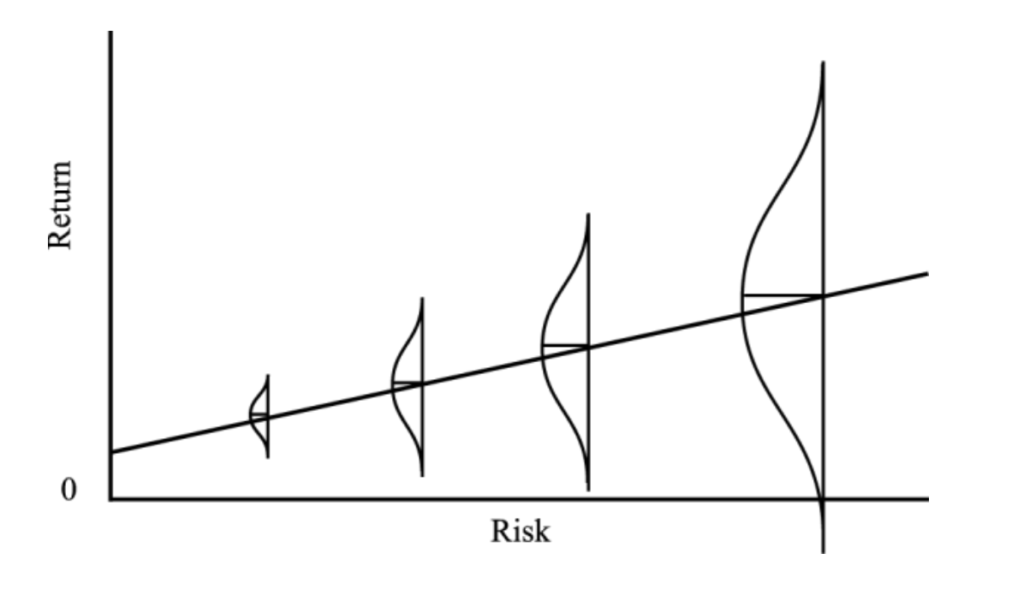

High risk investments have the potential for higher returns. They also have the potential for worse returns.

It would be more accurate to say that high risk investments have a wider range of expected investment returns compared to a conservative investment.

How much pain can you take?

In other words “What is your risk tolerance?”

When you are asked this, you’re actually being asked:

- How will you feel if your investments go down?

- And if your investments go down how will that impact your finances?

Without prior experience you can’t know with certainty how you’ll feel when your investments decline. After all, it’s a feeling.

If you don’t care about the ups and downs. And your stock portfolio has little impact on your day-day finances, you would be defined as having a high risk tolerance.

The opposite feelings would result in a person having a low risk tolerance.

But there is one major factor that shifts an investor’s view of risk, that is…

Time Horizon

The amount of time before you need to access your savings

If you are purchasing a home in a year and know you’ll need $100k. You’re going to be anxiously watching your portfolio of stocks bounce around, even if you’re an aggressive investor.

On the flip side, a more conservative investor could accept some stock market volatility (more risk) if they knew they wouldn’t need the funds for 25 years.

Depending on time horizon an aggressive investor can have a low risk tolerance and a conservative investor can have a high risk tolerance.

All of these factors need to be considered when an investor is determining their risk tolerance.

Increasing your Risk Tolerance

One of the biggest “own goals” in personal finance is increasing your risk tolerance with your investments to make up for lost time.

“I’m a bit behind on my retirement fund so I’m increasing my risk to get better returns”

Maybe this works if half your account is in GICs. But if the majority of your portfolio is in stocks taking unnecessary risk usually does not end well.

The market doesn’t care about your timeline for retirement. And things can go a lot more wrong then right with this kind of approach.

If you’re already fully allocated to stocks there are other strategies you can use to hit your retirement goals

Another way to mess up

You could use the equity in your home to invest. You get a mortgage from the bank and use the proceeds to invest in the stock market.

On paper this strategy does work. But the benefits accrue after longer periods of time, 10, 15, 20 years.

Earning an extra few percent over 5 years does not make a ton of difference.

The problem with this strategy is that you’re almost guaranteed to get a large market selloff at some point. And if you act improperly when the decline happens you’re going to be worse off than if you hadn’t borrowed to invest.