Is your money really working for you if you’re worrying about it all the time?

You invest in a stock expecting huge returns and all you do is watch it on the screen.

When Dogecoin was a thing (remember that) I was checking the price 10x per day. For a tiny position too.

I had investments 100x the value of Dogecoin which I would hardly check. My smallest investment received all my attention. Why on earth is that?

At some level it’s because you don’t believe in the value of what you’re investing in.

It’s like delegation. If you’ve assigned a task to someone and you’re confident in their abilities. You won’t check in with them aside from when the task is due.

You believe in them.

If you have no confidence in their abilities you’ll be wondering whether they’re doing it right. You’ll feel the need to “check-in” before the task is due. You don’t want the deadline to come around and find out they did everything wrong.

It’s why real estate is likely the best investment most people will make.

Housing isn’t a great investment but for most people it’s the best investment they will ever make because it’s the only asset they will leave alone and let compound for 10,20,30 years.

— Morgan Housel (@morganhousel) July 27, 2020

Real estate is easy to “get”. You understand it, it’s simple and it serves a tangible benefit.

Everyone’s got to live somewhere, right?

It’s why knowing what you own is so important.

More importantly, because it’s simple and tangible, you believe in it. And because you believe in it you’re not frequently checking the value of your home.

“How much is your home worth?”

“I don’t know, probably somewhere between this and this”

You would never say that for a stock, the price is flashed in front of your face every day.

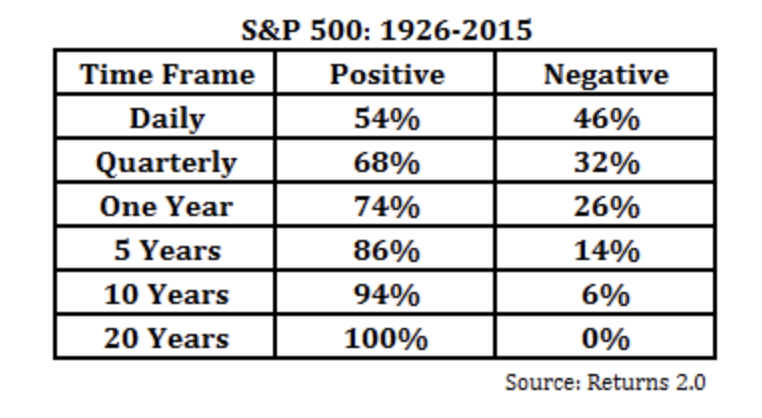

I think this is part of the reason why index fund investors are successful in their approach.

It’s much easier to believe that in 20 years the US economy will be more productive and profits for businesses will be higher.

It’s difficult to believe this will be the case for an individual company. And to determine whether that will be the case you have to constantly be updating yourself with new information on the business. It’s a lot of work.

When things don’t work you can also ascribe your losses to something more general as opposed to specific. When an individual stock you own goes down, you think “Is there something I missed? Do I really understand this stock as well as I think I do?”

When your index funds go down, you don’t think twice about it. Stocks go up, stocks go down. It is what it is. In the long term it will all work out.

This goes doubly for any investment that doesn’t have anything tangible associated with it. At least when you invest in Apple stock you know there is a business there. With something like Dogecoin it’s totally made up – the value of it is dependent on what other people believe the value is.

On a podcast from a couple years ago Theo Von was talking about his investment in Bitcoin and said:

“Recently I was investing in cryptocurrency, it’s like invisible, I don’t even know what it is, but people are excited by it. I started to notice that I’d wake up in the middle of the night and I would check this thing. I realized I’m spending important time checking it and I realized that I became a slave to it, so I just sold it all. It didn’t feel good to have the distraction of checking all the time to see what was going on with this money, it just felt like it owned me.”

Clip Here

Staying power in the long run is the most important factor for long term investment success. Believing in what you own will give you the staying power.

You’ll own those investments, come hell or high-water. Your investments won’t own you.