Rent vs. Own

Thomas Kopelman’s (@TKopelman) recent article outlines the numbers of owning a home. This discussion is difficult because everyone’s experience with home ownership is different. And most people don’t keep track of all the money they’ve put into their homes. Making it difficult to compare vs. other investments, or vs. renting.

We’ve written our own article focused on Canada and how renting out your basement may change the answer.

Garth Turner also wrote about Renting vs. Owning (for the GTA) in his daily blog, The Greater Fool. Garth lays out the financials, a renter is out less $$ per month compared to a home owner.

I have heard that many owners of negative cash flowing condo buildings are parents buying a place for their kids. Fearing they may never be able to buy a home.

These parents aren’t happy to be losing money, but they view it as a lesser evil.

From a technical perspective Garth lists $3,570 as the monthly payment. But ~ $900 of that is principal, that money increases your equity in the property. It’s not exactly a “cost” in the same way that interest is.

That doesn’t change the fact we have a dramatic housing shortage. You can argue whether we need certain types of legislation to fix this. At the end of the day there needs to be more places to live. The supple/demand inbalance won’t fix itself.

Active Funds

Financial Samurai had an interesting article on why people own active funds.

You can argue whether his views are right or not, but it made me think of two things in particular

- People do not do things purely for financial reasons.

- The job of an advisor/financial planner is a lot more about human psychology. Being there to talk clients through different financial decisions. In fact I would argue it is more psychology than technical work

Being curious is good, and finding out what works for you (especially when you are young) is a good thing. You’re not supposed to know it all, and you’re supposed to make mistakes.

Say Yes

I always enjoy reading Scott’s weekly article when it hits my inbox on Friday’s. This week was no exception.

My favourite blurb from the article was:

Going on to the second place and being more forthright with your emotions are asset classes that are oversold. Similar to Florida real estate in 2010, they offer huge returns. After brunch/CrossFit/writing class, walk around or grab coffee. Organize a backyard BBQ or beers on the roof. Also, when any positive feeling or thought strikes you, emote it. Tell your friends you hope you’ll be friends for life; tell people you are attracted to them; laugh out loud and touch people. We are emotional, physical beings — to not express our emotions in person, through shared experiences, is to be less human. Less alive.

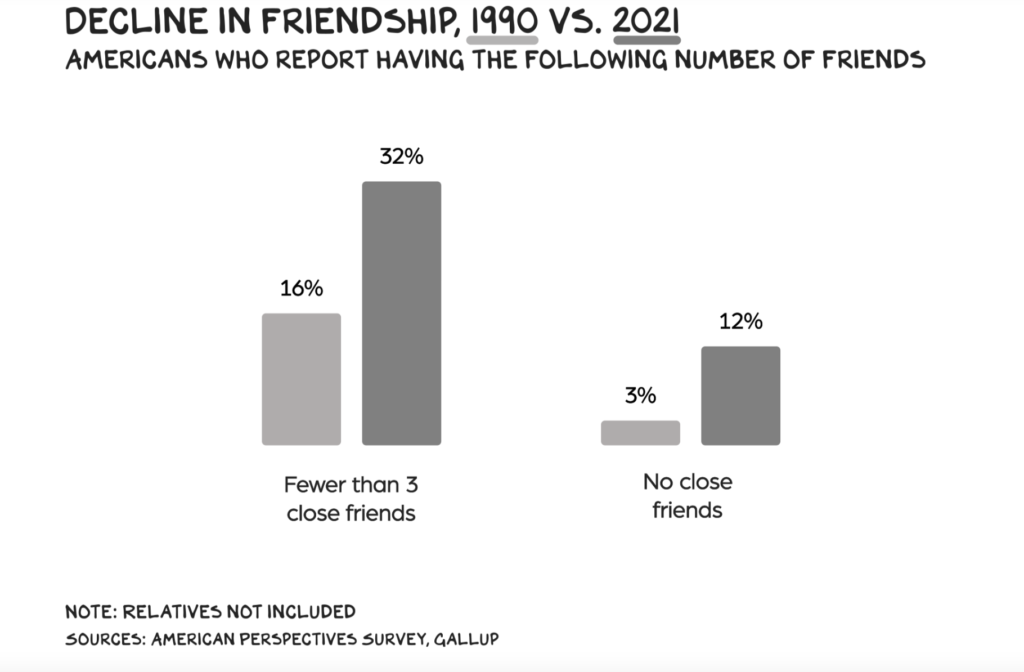

I am still struck, but not surprised when I see this chart:

In Howard Lutz’s “Longevity Simplified” there are many activities we’d expect to increase our health-span and life-span, but two I don’t think most people would have guessed:

- Socializing

- Having a Purpose

You’ll live a much happier (and probably longer) if you’ve got a good crew of people to enjoy life with.