Determining the exact amount you should withdraw each year for retirement is impossible.

If you had those forecasting powers I’d be calling you to tell me where the next big market move would be. Then I could retire with you.

To determine the “best” withdrawal amount would require you to know

- When you’re going to die

- How the stock and bond market will perform

- Future interest rates

- Future inflation rates

- How much, to the penny, you want to die with

The best we can hope for is to be in the ballpark of the “best” withdrawal amount. It’s a moving target too, and is primarily a function of investment performance unless you have a major lifestyle shift.

Poor stock market performance is a good reason to consider adjusting your withdrawal amounts. But by how much should you adjust them? The amount you should adjust your withdrawals will vary greatly depending on your end goal. Do you want to pass away with nothing, do you want extra funds to fulfill wishes to your family or favourite charities?

Lets look at an example….

Tom & Sarah

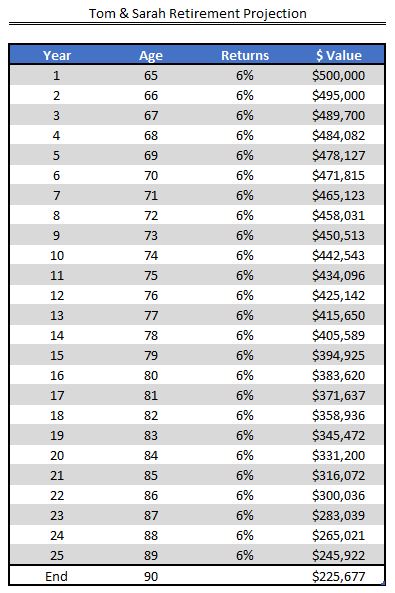

- They are both 65 years old, expecting to live to 90

- They have $500,000 saved up

- Along with their government benefits they need $35,000 annually from their investments

- Their investments are expected to earn 6% annually

- They would like to leave $50,000 to each of their two children

They’ve got 25 years to retirement, can they fund their own financial needs and provide a lump sum to their kids?

Based on their initial projections it looks like they can, and with room to spare.

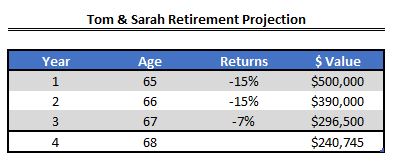

Confident in their projections, Tom & Sarah begin their retirement.

But after a few years they are stressed. Their portfolio has not earned the projected 6% annual returns, in fact they’ve lost money. Unsure of whether they can meet the targets from their original projection they sit down and re-evaluate.

After only a few years their portfolio is valued at $240,745. In their original projections they expected to be at this value when they were 90!

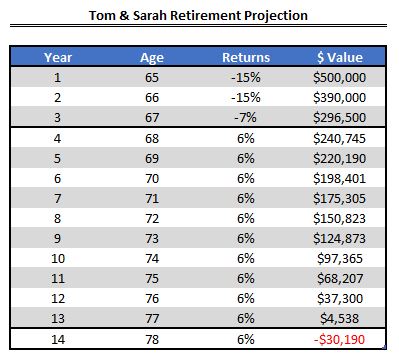

Using the same return projections, adjusting their age and asset values, Tom & Sarah project how long their retirement assets will last them.

Now to achieve their financial goals they have to

- Increase their investment returns

- Typically not a good strategy

- Reduce their withdrawals

- By how much?

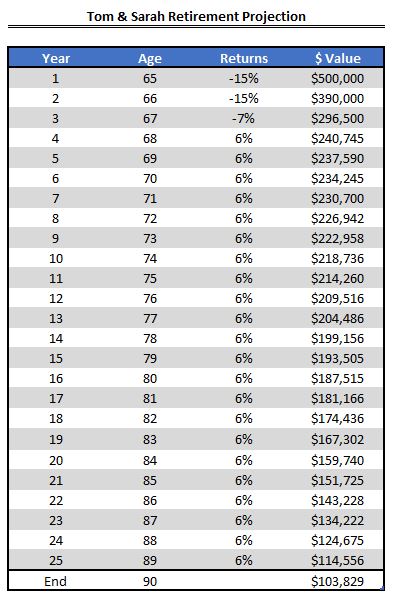

To reach age 90 with $100,000 to provide financial gifts for their children they’d need to reduce their withdrawals to $17,600 annually, using the original 6% return assumption. About half of their planned $35,000 annual withdrawal.

This is a significant shift in spending. The fact that Tom & Sarah experience such a severe decline implies that their investments weren’t appropriate for them. There are many moving parts when planning you’re retirement, it’s not a set it and forget it strategy. Retirement projections should be revisited regularly so you don’t wake up to a shock one day and realize you’ve got to dramatically change course.