Beginning your retirement and seeing the value of your investments decline is stressful to say the least. Setting up a financial plan and expecting setbacks to occur is prudent, but it doesn’t prevent the worry when it happens.

We’ve looked at how poor investment returns early in your retirement can have an outsized impact on the value over your investments. But when you experience this, what can you do?

Decreasing withdrawals from your investments

This is the obvious change to make. It’s within your control and has a direct impact in avoiding sequence of return risk.

The hard part is figuring out how to avoid spending, or if you even can. Say your non-discretionary spend in retirement (rent, utilities, food) is $25,000 annually it’s difficult to go below this amount, it requires serious lifestyle changes. Changes that you understandably don’t want to give up in retirement.

If you projected spending $50,000 annually in retirement and $25,000 of this was discretionary, say for travel, adjusting your spending down is easier. Still not easy though.

How much do I need to decrease my retirement withdrawals?

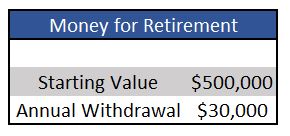

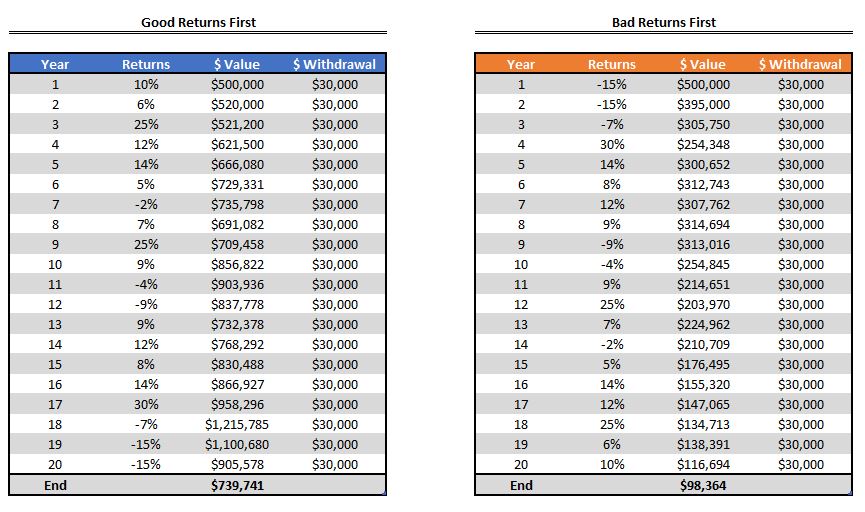

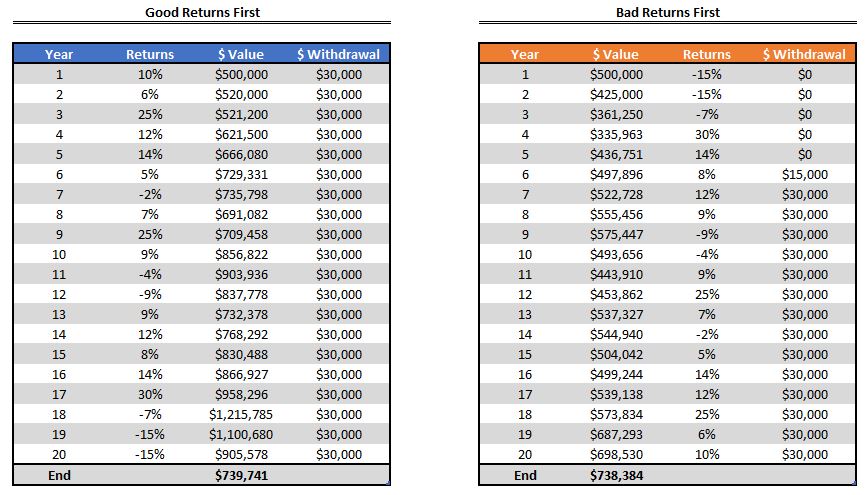

From this article, we can see the impact of poor investment returns early in your retirement

To equalize poor market performance early in retirement you’d have to delay withdrawals entirely for five years! The equivalent of delaying your retirement for that entire period.

Delaying retirement for five years is a tough (read, near impossible) ask. Making the plunge to retire is not a decision taken lightly, most will have planned for a few years already.

To be fair, delaying retirement to adjust for the amount of money you could have had, doesn’t make much sense.

But it does illustrate how impactful it can be. All that matters is that you have enough money to achieve the retirement you want. Whether that’s

- Being able to live comfortably without having to work

- Being able to travel for 3 months of the year

- Donate time or money to your favourite charitable causes

- Spend more time with family

- Help your kids buy their first home

- Leave a legacy for your heirs

You don’t have to make all or nothing decisions either. You could…

- Reduce your retirement withdrawals by a smaller amount, for a longer period of time

- Use a variable percentage withdrawal strategy to determine your withdrawal amounts

- Decrease the number of hours you work, or consult on the side

- This suggestion is geared more towards business owners and other professionals

All of these strategies “work” but you have to find which one aligns best with your personality and specific financial goals.