Having a financial plan does not mean you’re going to be rich. The purpose of a financial plan is to map out how you’re going to achieve your financial goals. As well as the priority of each of your goals. A financial plan is helpful, but to have a lot of money, the most important factor is having a high income. Sounds obvious, and it is. To illustrate this….

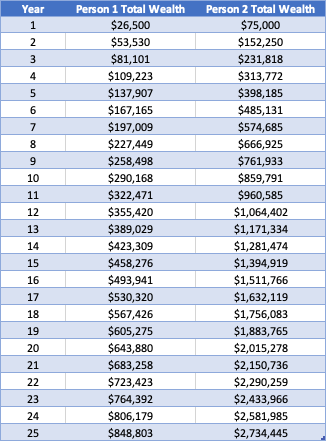

- Person 1, earns an average salary that increases 2%/year, beginning at $50,000, saving 50% of their income

- Person 2, earns an above average salary that increases 3%/year, beginning at $150,000, saving 50% of their income

Person 1 invests their savings and earns 6% annually from a stock portfolio, after 25 years they’ve saved $800k. Person 2, doesn’t invest their money at all and ends with over 3x as much.

Like most things the answer is simple but not easy. To get rich you need the one or both of the following skills:

- A consistent way to make a high income

- See this article, or the example at the end of this article

- The ability to value assets, and ideally, manipulate the value of the asset directly

- Think of a real estate investor that can accurately determine the value of a rental property, and knows which renovations will increase the rents and overall value of the property.

The ability to value assets is a more difficult skill, and it requires capital. Generating a high income is less risky, but it generally requires more time. Generating a high income requires you have a valuable skill, which by definition is hard to obtain, otherwise they wouldn’t be valuable.

If you can do both steps, you’ll be stinkin’ rich because you’re earning high rates of return on large dollar amounts.

So…. how do you get a high income?

I think most people intuitively think of a wealthy person as someone who’s invented something, bought shares in some early stage startup or built some app and sold it for a kajillion dollars. The reality I see, blue collar and white collar, is that most wealthy people offer a pretty average service, but provide it with above average quality.

However there are technical characteristics about the work they do, which allow them to earn high incomes…

- Their skillset can be the foundation of a business

- They can use their skillset without the support of a large organization

A few examples of careers that meet these criteria are:

- Accountants

- Lawyers

- Most Skilled Trades

- Doctor

- Engineer

- Architect

This isn’t to say you can’t have a high income within a large organization. But this is the route I’m familiar with and have seen play out. I’m sure there are positions within large organizations that can earn high incomes, and if you can see the path to get there, that works too.

A Real Example: Bookkeeper to Accountant to Consultant

The hierarchy of labour flows from basic labour, to specialized labour, to a product. Here’s a real life example of an accountant, and the path they took.

- Basic Labour

- Sally likes numbers and after finishing her undergrad works at a local accounting firm, specializing in small business tax returns. She’s taken basic finance and accounting courses, so she begins as a bookkeeper (which probably straddles the basic/specialized labor spectrum).

- Specialized Labour

- After working a few years at her bookkeeping job, Sally decides she’d like to increase her abilities and pursues her CPA designation. After getting her CPA she is more valuable to her firm, and friends and family start taking their tax returns to Sally’s firm now that they’re more confident in her abilities.

- Selling a Product

- After a few more years Sally becomes an expert in estate planning solutions for business owners. She is able to maximize the after tax proceeds the owner receives, and helps them plan the transition of the business to the next generation. Sally has started getting referrals from clients, and she doesn’t need to stay at her accounting firm to generate business. Sally starts her own business from her home and charges a flat rate of $15,000. Client’s save much more tax than her fee, so they are happy to pay. The first few years are slow. Sally was making more at her previous firm, but each year she gets more business than the last. In year 10 she increases her price to $20,000, and is doing 12 consultations a year. She has no overhead and pockets most of the business’ revenue. Fast forward another 10 years and her fee has increased again, to $35,000, and she works with 20 clients a year. Client’s don’t care whether it takes Sally 5 or 50 hours to provide a solution. They care about achieving their tax, estate and business transition goals. They are now paying for Sally’s judgement, the end product, and not her labour.

It’s a long road to get to the final step, but if you want to get rich you need to have a high income. A financial plan can help, but it won’t be the determining factor