Sequence of return risk is one of the sneakiest hurdles impacting retirement projections. It’s not well known, but given its impact it should receive more attention.

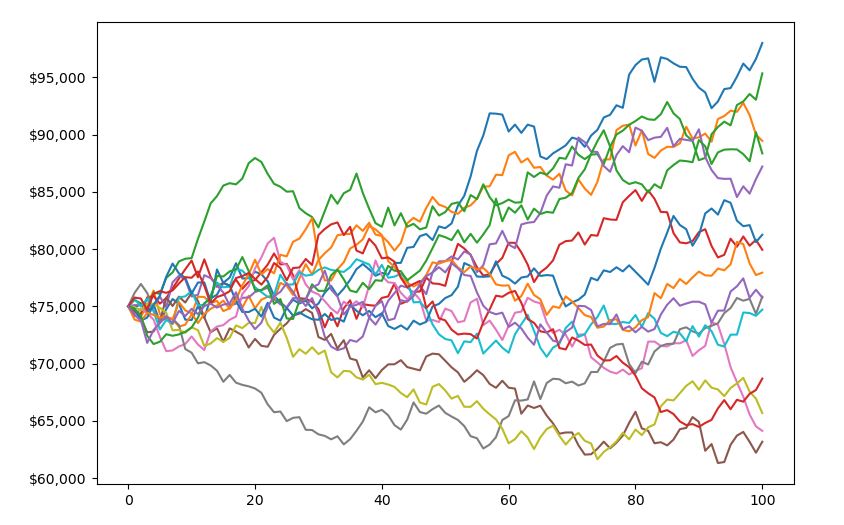

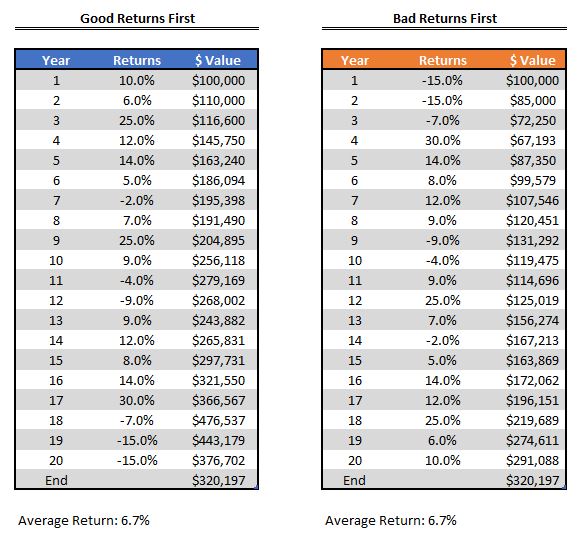

Sequence of return risk refers to the order you receive your investment returns. But this risk only exists when you are withdrawing capital. The order you receive your returns does not matter if you aren’t withdrawing from your investments. Two return paths are below, path one receives the best returns first, path two receives the worst.

Both portfolio’s end with the same value, turning $100,000 to $320,197 over the period, but see how this changes when you’re drawing down capital for retirement income.

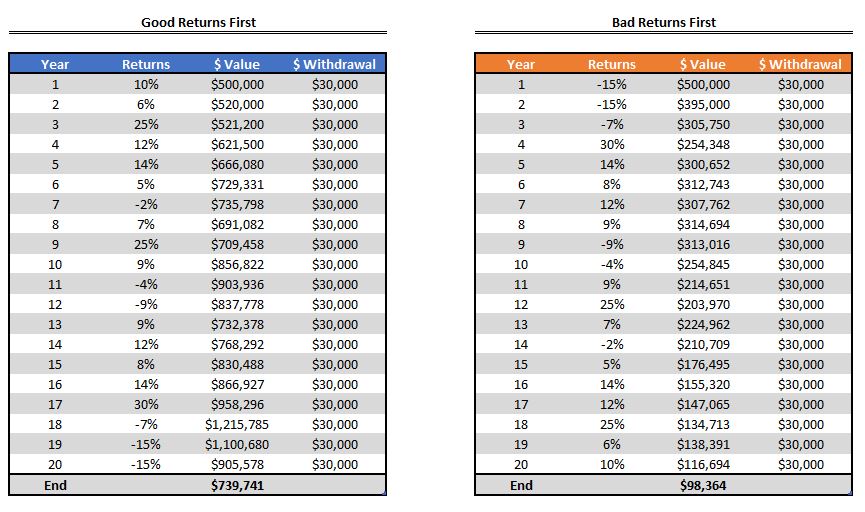

When you receive the bad returns first you end up with $98,000, instead of $739,000 when receiving the good returns first. Even though they earn the exact same annual returns.

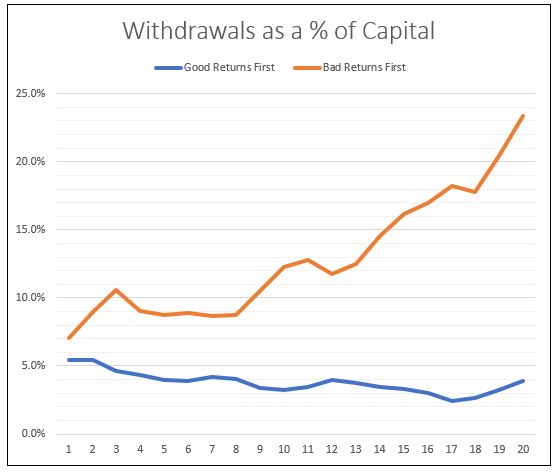

This occurs because your withdrawals as a percentage of your total investments increase. Once the returns do start to improve there isn’t enough capital for your assets to grow by a meaningful dollar amount.

So, what can be done to combat this?

- How can we adjust course if the first years of retirement had poor investment returns, and my withdrawals are taking a bigger chunk of my savings each year

- If I haven’t retired yet, how can I take sequence of returns into account and structure my investments to best avoid this?