RRIF vs LIF: What Are the Similarities and Differences?

RRIF vs LIF: Do you know the basic differences between the two systems? Here, we compare the two funds and highlight their similarities and differences.

RRIF vs LIF: Do you know the basic differences between the two systems? Here, we compare the two funds and highlight their similarities and differences.

If you know you need life insurance. And if you know how much life insurance to get. The final question is which type of life

We wrote a separate article to help you determine whether you need life insurance or not. And if you’re here I can assume you do.

Life insurance is something that comes up a bit later in life. Most people know life insurance exists, but they don’t know what the use

Nobody wants to pay extra fees if they don’t have to. Especially to the government. From this perspective it would make sense to avoid probate

I had a client ask me this question for the first time. It was such an obvious question, but I have never been asked it

LIRAs (locked-in retirement accounts) and RRSPs (registered retirement savings plans) are two popular retirement savings plans in Canada. Both plans offer tax-deferred growth, meaning that

While the acronyms sound similar, the RRSP and RDSP are designed for entirely different purposes. In this in-depth RRSP vs. RDSP comparison, we will cover

OAS clawback is something that many Canadians know about, but don’t know the details. All you know is that the government can “claw back” the

Figuring out how much money you need in retirement can seem overwhelming. There are many variables to consider – government benefits, expenses, inflation, home ownership,

There are traditional and non-traditional retirement income sources to provide income during your retirement. If you can’t pay for your retirement expenses using traditional methods,

There is no way to know this with 100% certainty. And I think this trips most people up. They think “It’s unknowable to know exactly

The battle of the two most popular tax free accounts in Canada.

So, what are segregated funds? Segregated funds are investment funds that have maturity and death benefit guarantees associated with them. Think of them as “mutual

A decision with no right or wrong answer part 2.

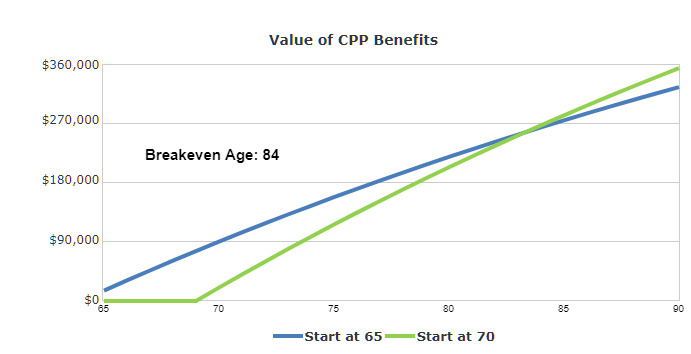

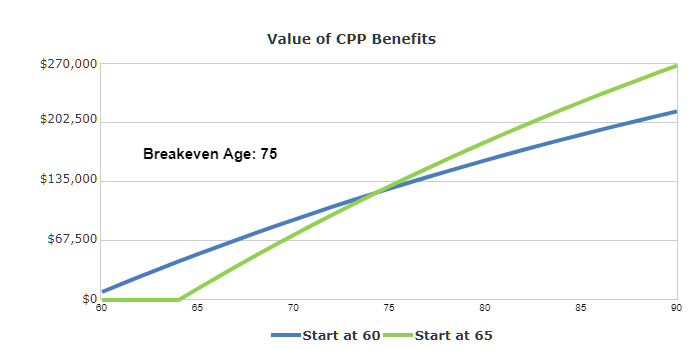

Everything you need to know about CPP

It may take awhile, but he’ll be proven right

You can’t make a “player” do something they don’t want to do

Future Proof Weekly – June 23, 2023

If riskier investments could be counted on to produce higher returns. They wouldn’t be riskier.

Future Proof Weekly June 19th, 2023

Future Proof Weekly – June 10th, 2023

Retirement options when selling your home isn’t an option

Future Proof Weekly – June 4th, 2023

Easy in theory, difficult in practice

Adding a few extra items to your home purchase checklist

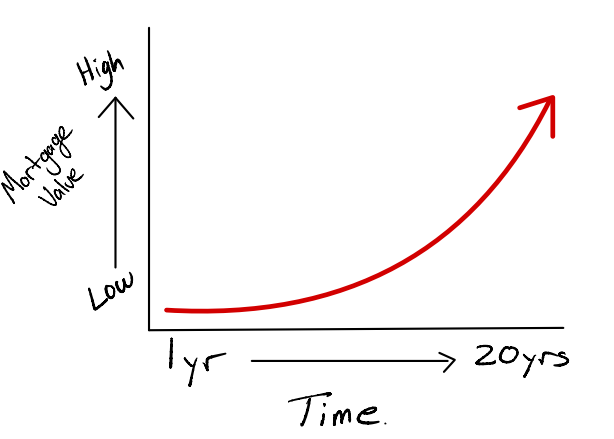

So you’re telling me the bank will lend me money and I don’t have to pay it back?

Adjusting course when your retirement projections don’t match reality

What to do when you go south and your retirement funds follow you

Splitting living expenses with a partner is not as straightforward as it seems

Renting out your basement might be the best investment decision you make

Looking past the sticker price and counting all the extra costs of home ownership

Do you need to have a financial plan to become rich? Probably not.

How to make sure your job allows you to climb the Hierarchy of Labour

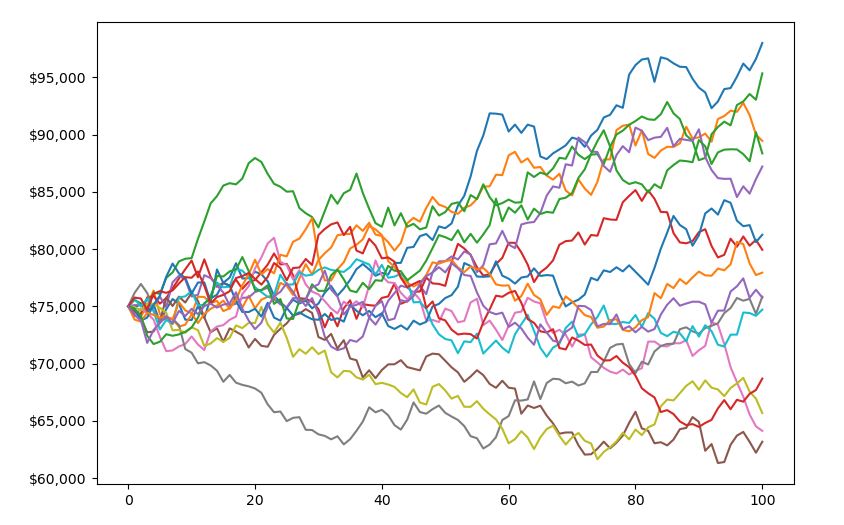

When you earn your investment returns can matter more than the returns itself

The first call is free to see if we might be a good match for you and your financial goals